What is the Difference in Deal Getting Deed And you can Rent In order to Own?

Both of these terms are often put interchangeably, doing misunderstandings for people consider their options for looking for a home. You will find crucial differences when considering contract having deed and you will lease so you can own.

Rent To possess

Rent to own aka book solution, book for, solution to pick, book having substitute for purchase, etcetera. are renting our home on intent to shop for they in this a fixed schedule (usually one to 3 years). Credit ratings are necessary throughout these rent plans just like the property owner otherwise possessions management organization have a tendency to eliminate borrowing included in the app techniques.

For the a rental for, the fresh landlord and renter concur up front on the a price when signing new agreement. Including, an occupant and property owner you will agree with a $200,000 price. Any moment from inside the book agreement the newest renter can purchase the home at this pre-calculated rates. This should generally occur once they are able to reach money away from a lender.

One of the benefits of lease having is that a tenant normally protect the current home prices as they improve the credit in order to receive financial support. A different sort of advantage to the latest tenant/potential consumer is the fact lease getting reserves the house for them; new property owner will be unable to sell to another client during their lease.

Rather than taking a protection put and another month’s book seen within the a normal lease; a property manager should request a non-refundable choice down payment ranging from step three-5% of your cost. This really is to offer the latest landlord cover while the intention is actually to purchase the house (therefore the main reason landlords invest in carry out a rent in order to own in the place of a frequent lease). Whether your tenant sales the home this package down-payment tend to go to your the investment, otherwise the newest landlord will keep they if the occupant moves away.

In other words, a choice down payment is low-refundable should your renter struggles to see financial money into the arranged schedule.

What is actually A monthly Rent Borrowing?

A monthly book borrowing is actually a share of your tenant’s lease being credited to your their down-payment and you may ultimate purchase. Imagine pushed savings package.

The new catch is the fact so it credit is close to usually according to above-ple, in the event the normal market lease to the residence is $1,600, the fresh new property owner tend to increase the lease so you’re able to $step one,750 so you’re able to take into account a lease borrowing from the bank off $150. Put differently, there clearly was no advantage to the fresh new tenant. It has to also be noted the brand new property manager keeps the newest lease borrowing from the bank from inside the book arrangement, while the latest tenant doesn’t do it their choice to purchase the home landlord reaches keep every thing.

That is Responsible for Home Fix Inside the Lease For?

Clients will be expected to deal with slight household fix commitments throughout their lease and additionally outside turf really works. not, big structural repairs including an alternate roof would be covered of the landlord’s existing homeowners’ insurance plan. Like any bargain, it’s imperative to take a look at the fine print you understand what your legal rights and you may requirements try.

The master of The house or property Inside the Contract Getting Deed?

There are many different differences when considering book to have and you can bargain having deed; control of the house is among the most essential difference to adopt. In the place of rent getting where its a landlord/renter relationships contract to have action customers: own the house or property, pay property taxation, hold homeowners’ insurance, and have complete duty having property repair.

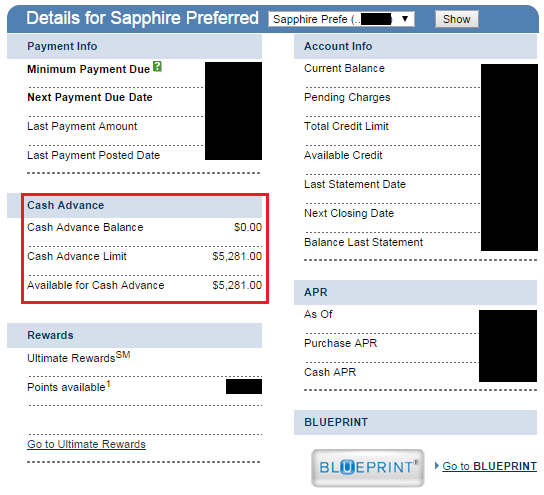

The down-payment is actually a significant element of deal for deed. Down https://elitecashadvance.com/loans/personal-loans-for-home-improvement/ repayments range between 10-20% of your own cost.

Really does Credit Amount?

Less than perfect credit or no borrowing is not a challenge. The zero credit assessment mortgage program is the number one need anybody follow offer getting action as opposed to rent to possess.

Including a financial home loan otherwise car finance, a contract having action can get an effective interest rate with an effective place title (ex: 30yr or 15yr) where monthly prominent and you may notice payments are created. It reduces the financing harmony throughout the years, which can be an appealing replacement for throwing currency out towards an effective lease having.

It’s quite common which have contract to own deed for an excellent balloon fee, which provides a way towards owner/supplier to create a romantic date into once they want the buyer so you can re-finance to the a financial financial or promote your house. Its essentially a longer timeframe (as much as 5 years) in place of lease for where in actuality the rent is usually 1-36 months.

Are you willing to Create Home improvements?

Not only are you able to create home improvements having offer to possess deed, but you will also enjoy the new economic benefits of any increase within the really worth your work guarantee provides. It differs from rent having, the spot where the occupant isnt permitted to build topic improvements so you can the house before purchasing it.

If the a buyer cannot refinance to your a financial mortgage in the package to have action, they always have the option of promoting the house or property. At minimum they’re going to recoup its downpayment, and all their monthly installments one to went towards loan dominating.

Since the an additional benefit, with Minnesota home values continued to go up truth be told there also will extremely likely be a revenue thru home guarantee prefer.

Which gets a primary advantage over lease for the spot where the renter have no power to recover the solution down-payment, or leasing borrowing, when they unable to purchase the family. Worse, they could face eviction using their property manager.

Have there been Tax Positive points to Bargain For Action?

Same as a bank mortgage, the buyer is also deduct interest paid towards the loan too since assets taxes. That is a major advantage on lease to own.

Prepared to Make First step?

You may have come to the right place in the event that contract having deed tunes best for you. Call 651-307-7663 or complete the contact page to get in touch which have a verified MN price to own action buyer on CBlock Financial investments.