Brief Guide To own Prepayment of Home loan: The facts, How exactly to Shell out it, Costs, plus

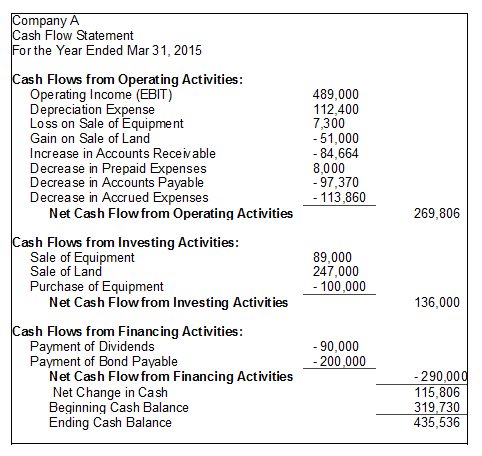

To buy a property is a big milestone inside man’s life. It not just will bring protection in addition to brings a guarantee off a safe place. However, having ascending assets costs, homebuyers often bring-home loans to fulfil their dreams of home ownership. However, often, the borrowed funds matter getting property pick is really a premier magnitude which ple, good homebuyer having pulled a home loan out of ?dos crores having a tenure out-of 20 years on nine% per year is required to pay an interest of around ?dos.step 3 crores. Moreover, in the event that home financing is removed during the a drifting rate from desire, new payable appeal amount is rise by a number of notches when your interest rates improve inside the tenure. One of the most innovative implies to have homebuyers to save with the their interest outgo try mortgage prepayment.

What’s the Prepayment away from financing?

During the peak times, most financial borrowers ask, “Do we pay home loan early?” The brand new prepayment of a mortgage, or any other loan, allows a debtor to repay the borrowed funds count up until the avoid of the actual period. Financing prepayment contributes to a decrease in all round attract amount this option must spend otherwise. There’s two ways that a debtor helps make the latest prepayment out of a loan:

Area prepayment

Whenever a borrower prepays a particular portion of the loan amount that was lent, we know once the part pre-commission. And then make a part-prepayment regarding a home loan contributes to the latest reduction of the dominating matter but not from the closure of the property financing membership. Adopting the area prepayment has been created, the interest is energized on the brand new principal number. And you will sometimes new period or the EMI count gets shorter.

Complete prepayment

Whenever a borrower pays the entire a fantastic dominating of your mortgage count that has been borrowed, it is known due to the fact full prepayment or financing property foreclosure. Doing this contributes to the brand new closing of mortgage membership, plus the borrower is not needed to spend then EMIs otherwise interest. But not, when an effective homebuyer decides to foreclose the loan membership, it’s possible to have to bear certain fees referred to as prepayment penalty towards the a mortgage.

Financial Prepayment Rules

This new Set-aside Bank off India (RBI) loans Bantam CT has actually put down particular guidelines to own banking institutions or other housing finance organizations to allow brand new prepayment out of home financing. Some of these guidelines were:

- A debtor tends to make home loan prepayment just following end from a particular months regarding the time where the borrowed funds is actually sanctioned. One can possibly learn about this era because of the training the borrowed funds agreement.

- If a home loan has been pulled by the a family otherwise a corporate entity, expenses financial prepayment costs gets mandatory aside from the sort interesting rates that’s relevant.

- Regarding private borrowers, this new prepayment of mortgage fees applies on condition that the newest interest rate is restricted. Getting home loans with a floating interest rate, the fresh prepayment fees try exempted.

- Loan providers can get request the new prepayment regarding mortgage fees to your fixed-speed lenders as long as the borrower has taken that loan out-of a different bank otherwise a construction monetary institution to settle the newest amount borrowed.

- The rate of which a homebuyer must pay the prepayment punishment to your a home loan is going to be decided collectively because of the one another people in the course of mortgage disbursal.

Mortgage getting Luxury Services

Lenders are particularly preferred monetary devices that enable men and women to purchase the fantasy property. After that, when someone try probably buy a premium deluxe possessions, providing a mortgage is an even more practical decision due to the fresh new entailing income tax benefits. That is one reason why why property such as for example Piramal Aranya inside the Byculla is actually a popular selection for home buyers. Which ultra-lavish land has the benefit of highest unlock room that have abundant greenery. This has most of the modern places a homebuyer want during the its fantasy residency.

In conclusion

The fresh prepayment from a mortgage will help individuals make ample deals. What’s more, it allows them to beat its EMI number otherwise payment tenure. However, you need to conduct a payment-offers assessment to help you analyse if it could be winning in order to prepay home financing on confirmed day and age or perhaps not. To understand just how to shell out a home loan early, you can get in touch with the newest lender’s customer support team.

Disclaimer- This information is based on the pointers publicly designed for standard play with and site hyperlinks stated herein. We really do not claim any responsibility regarding your genuineness of same. Everything provided here cannot, in fact it is perhaps not designed to, constitute legal advice; as an alternative, its to possess general educational objectives only. I explicitly disclaim /disown people liability, that could occur due to any decision drawn because of the any person/s foundation the article hereof. Members will be get independent pointers when it comes to people sort of advice considering here.