Funding Domestic Renovations: Do it yourself Funds vs. Credit cards

A recently available survey unearthed that along side second 2 yrs, home owners greet they purchase on average $eight,746 into the home fix and you will update tactics.

Although not, on fears of a looming recession and a difficult cost savings, of many inquire how they will pay for these types of repairs. 34% regarding respondents stated it want to explore credit cards, that is a nearly 5-flex boost in mastercard utilize versus early in the day year’s conclusions.

Because a home improvement elite group, understanding the pros and cons from money a venture that have an excellent do-it-yourself mortgage compared to charge card is condition you as a great of good use self-help guide to your web visitors, which could help you victory alot more systems. Keep reading to learn more about the advantages and you can disadvantages out of consumers playing with playing cards to finance a venture with you.

Playing cards: Advantages and Downsides

- Convenience: Playing cards provide unmatched comfort with regards to to make purchases, as well as those people connected with household home improvements. Your potential customers can purchase characteristics having a swipe otherwise a spigot.

- Zero Security Needed: Playing cards fundamentally none of them collateral, as opposed to do-it-yourself money. It means your potential customers won’t have to set their residence or almost every other beneficial assets on the line so you can safe financial support.

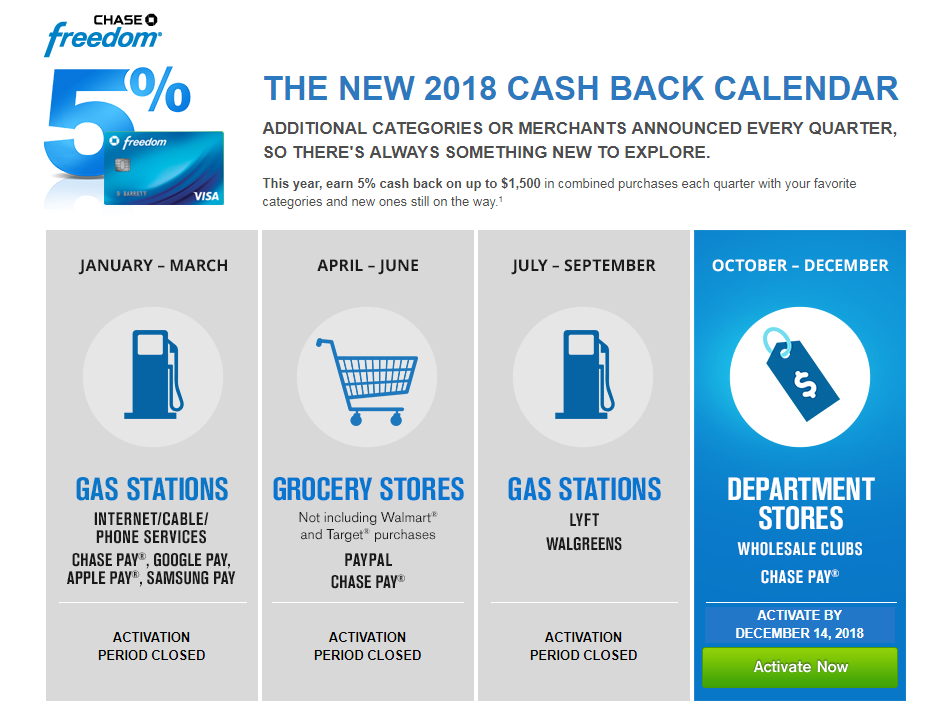

- Interest-100 % free Period: Specific handmade cards want-free introductory months. During this period, your visitors helps make instructions in the place of incurring notice charges once they afford the equilibrium in full monthly.

- High-Interest levels: Playing cards usually bring higher-rates, particularly if a balance is actually managed beyond the focus-totally free months. Through the years, this type of appeal fees normally gather and you will rather improve restoration will cost you.

- Limited Credit limit: The financing limit on your own user’s credit might only safety part of the restoration expenses, pushing them to explore multiple cards otherwise seek a lot more money.

- Minimum Monthly premiums: Handmade cards bring independence, nevertheless they also require users making minimal monthly obligations, which can end up being a weight if you fail to pay-off the latest balance swiftly.

- Control Charge: Of a lot bank card operating suppliers charges people a fee to process this new deals.

Do-it-yourself Money: The benefits and you will Disadvantages

- All the way down Rates of interest: Home improvement financing usually installment loans online in Iowa render down rates versus borrowing cards. This will translate into substantial deals when you look at the notice costs across the life of the mortgage.

- Fixed Installment Conditions: With property upgrade financing, your clients will get a predetermined fees agenda, making it simpler to help you plan for brand new project’s will cost you over time.

Whenever consumers try to choose from a house improvement financing versus. playing cards for their recovery project, they sooner relies on the finances and choice. Handmade cards offer comfort and you will freedom but have large notice rates, when you’re do it yourself loans bring down rates plus tall loan number however, wanted guarantee.

To suit your consumers and then make an informed choice, it is best to consult an economic coach otherwise lending pro to choose the greatest funding selection for their demands. That is where a talented specialist money credit partner steps in. Armed with an in-depth understanding of the industry, such creditors provide more than simply resource. They offer a collaboration that aims to learn and you may appeal to the particular requires off do-it-yourself companies and their consumers.

Lover Pass with Salal Broker Lead

I team up that have builders across the country to add their customers that have affordable investment for different solar and you may do-it-yourself projects.

We can give several of the most competitive costs and you can broker costs as we have been part of a part-possessed credit partnership. Meaning all of our earnings return to the participants-and you will team partners-owing to straight down cost and you may a lot fewer fees.

The place to start Offering Salal Agent Resource to People

We are seriously interested in helping your business build having quick resource moments and you will personalized assistance off a loyal and you will educated party away from credit pros. To get going, the dealer software processes demands these types of documents: