New charge conditions and you will constraints for global students to find an excellent mortgage differ of the lender

Charge Requirements and you can Limitations

Likewise, International Capital Feedback Board (FIRB) acceptance is needed for low-long lasting customers to buy assets in australia. Around 80% of the cost will be borrowed, having a good 20% put as well as costs needed.

Securing a deposit of at least 20% in addition to 5% to pay for a lot more expenses such stamp obligation, which have somebody employed complete-go out, having a positive credit rating around australia, and you will displaying sound discounts means when you’re discovering should assist in improving the fresh new likelihood of mortgage acceptance.

Parental Guidance and you may Guarantors

Good guarantor is actually somebody who undertakes to visualize duty to own financing whether your debtor cannot see the payment financial obligation. Which have an effective guarantor (usually a grandfather) normally help the odds of mortgage acceptance and relieve extent of put you’ll need for around the globe pupils.

The requirements for having good guarantor can vary according to lender, however, essentially, they have to possess an optimistic credit history, a reliable revenue stream, and you will individual a property. The process getting acquiring a guarantor usually necessitates the guarantor to help you signal a loan agreement and gives proof money and credit records.

Boosting Your odds of Mortgage Acceptance

To boost the possibilities of loan approval, it is vital to have a good credit history, show genuine discounts, maintain a steady money, and relieve established individual expense. Likewise, it is critical to apply for the ideal amount and you will review the qualifications conditions.

Maintaining good credit is very important getting financing approval once the this means so you’re able to lenders that you will be a reliable borrower and you will will likely be top meet up with the mortgage fees.

Building a Credit rating

A credit rating from 661 or 690, according to score’s list of 1,2 discover here hundred otherwise step one,000, is considered as good credit rating. Starting it score involves and make punctual costs, maintaining a low credit utilization proportion, and having a lengthy credit score.

Keeping an optimistic credit history is useful as it can possibly qualify one to get more good financing conditions and you can rates, hence demonstrating economic responsibility.

Saving getting in initial deposit

Preserving to possess in initial deposit is a must for mortgage approval whilst ways so you can lenders that you possess the needed financial resources to help you satisfy the loan costs. A deposit of between 20% and you will 30% of one’s full amount borrowed, having a supplementary 5% necessary for get can cost you, is typically you’ll need for student mortgage brokers.

When saving up into put, you might choosing the most affordable scholar hotel from inside the Brisbane otherwise any kind of urban area you happen to be living in to cut down expenses.

Ideal approach to protecting to own in initial deposit will be to identify a target number, display screen expense, introduce a viable finances, find a savings account having an aggressive rate of interest, and you may establish automatic offers.

Demonstrating Steady Money

Steady money makes reference to a normal and you may reputable source of income that can be used to display monetary balances. With somebody otherwise constant money can increase the probability of mortgage acceptance due to the fact loan providers account fully for house money when determining a credit card applicatoin. This will make it more comfortable for a couple of individuals become acknowledged, particularly if you’ve got a routine full-time money.

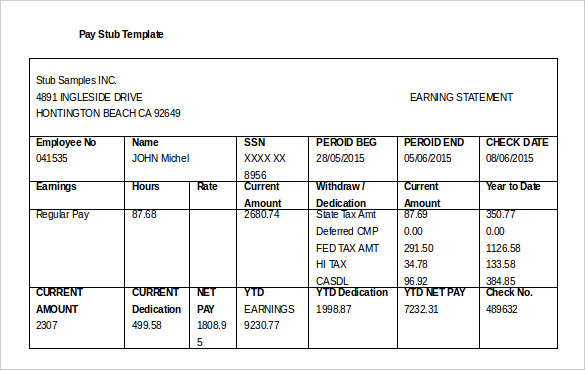

Keeping a reliable money, providing spend stubs or tax returns, and you will showing a robust coupons history are the best steps for indicating consistent income.

Navigating your house Loan Techniques

Our home financing techniques involves numerous steps, you start with pre-approval, followed by software, underwriting, and eventually closing. In order to commence, people need get an excellent conditional pre-approval, following see a property and implement having a home loan.