Remedies for brief financial demands inside underserved communities

Almost every other agencies, for example nonprofit communities and you can area innovation loan providers (CDFIs), are development and you may providing small mortgage products that explore easier, even more flexible underwriting actions than many other mortgages, for this reason cutting origination can cost you. 57 Where these materials are available, he has enhanced access to small mortgages and you can homeownership, particularly for reduced-income family and you can homebuyers out of color.

Though these types of attempts is actually promising, highest repaired costs are likely to continue to make short mortgage origination difficult, plus the extent to which laws and regulations governing loan origination apply to-otherwise will be securely altered to lessen-these can cost you are undecided. Unless of course policymakers target the big challenges-large repaired costs and their vehicle operators-loan providers and you will authorities are certain to get challenge delivering creative remedies for scale to alter access to quick mortgage loans. Future browse should continue steadily to discuss an easy way to reduce costs for lenders and you can consumers and you may line up regulations that have a smooth mortgage origination procedure, the when you’re protecting individuals and keeping business stability.

Structural barriers eg high repaired origination costs, ascending home prices, and you will bad domestic top quality partly give an explanation for lack of quick mortgages.

And although quick mortgages have been decreasing total, the possible lack of borrowing availability has an effect on particular communities more others, operating particular buyers towards riskier option financing plans or leaving out them out-of homeownership entirely

To raised assistance organizations in which quick mortgages try scarce, policymakers should keep the requirements of more underserved populations within the head when making and you may implementing rules to boost the means to access credit and you will homeownership. No single policy is also raise short financial accessibility in almost any community, but Pew’s performs means that architectural traps was a primary rider of brief mortgage scarcity and that federal policymakers can also be target several secret elements to make a meaningful perception:

But consumers and additionally deal with other barriers, instance large denial prices, complications while making down repayments, and you may competition during the houses areas inundated having buyers or other cash buyers

- Vehicle operators off mortgage origination will cost you. Policymakers is always to examine national compliance conditions to decide how they apply to costs and you may identify an easy way to streamline those people mandates rather than growing chance, instance by way of the new economic tech. While the FHFA Director Sandra L. Thompson manufactured in : For the past decade, mortgage origination will cost you enjoys doubled, while you are beginning times possess remained largely undamaged. Whenever utilized sensibly, technical provides the possibility to boost borrowers’ skills by reducing traps, expanding efficiencies, and minimizing will cost you. 58

- Incentives you to definitely remind origination away from large in place of faster mortgage loans. Policymakers will having an approach to discourage compensation formations you to definitely push mortgage officials in order to prioritize larger-equilibrium financing, eg figuring loan officers’ commissions centered on individual financing beliefs or total financing regularity.

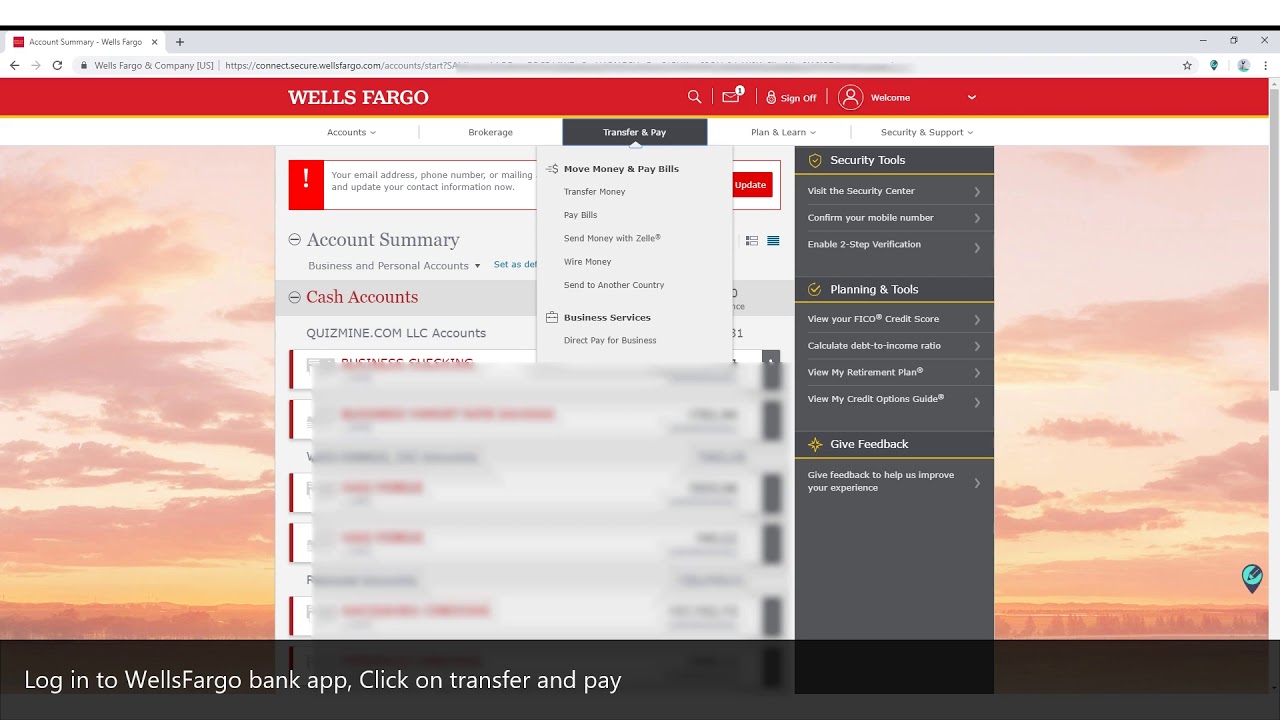

- The bill ranging from general risk and you will the means to access borrowing. Regardless if supporters and you may industry stakeholders agree totally that bodies is always to always manage consumers from the sort of irresponsible lending practices one to shared for the failure of your property , underwriting conditions today prevent unnecessary people regarding accessing mortgages. 59 A more chance-open minded position regarding national could unlock usage of brief mortgages and you can homeownership for more Americans. Instance, the selection of the Fannie mae and you will payday loans no credit check no teletrack direct lenders Freddie Mac (recognized together once the Bodies Paid Businesses, otherwise GSEs) and you can FHA to provide a confident lease payment listing-in addition to Freddie Mac’s relocate to create lenders to utilize good borrower’s confident month-to-month bank account dollars-flow investigation-within underwriting process can assist grow access to borrowing to a broader pool regarding individuals. sixty

- Habitability from established lowest-costs casing and you will capital having repairs. Restoring reduced-costs homes you can expect to promote a great deal more opportunities to own individuals-therefore the property they wish to pick-so you’re able to be eligible for small mortgage loans. However, far more analysis must determine how adjust the present construction stock instead of broadening loan costs for lenders or individuals.