An alternate presumption one favors 401(k) fund ‘s the lack of charges

Charge and Expenditures

Yet not, of several 401(k) preparations costs origination and you can quarterly restoration fees, while bank loans generally dont. Which consolidation typically reduces the attractiveness of 401(k) financing. Specifically, these charge drastically increase the cost of brief 401(k) funds.

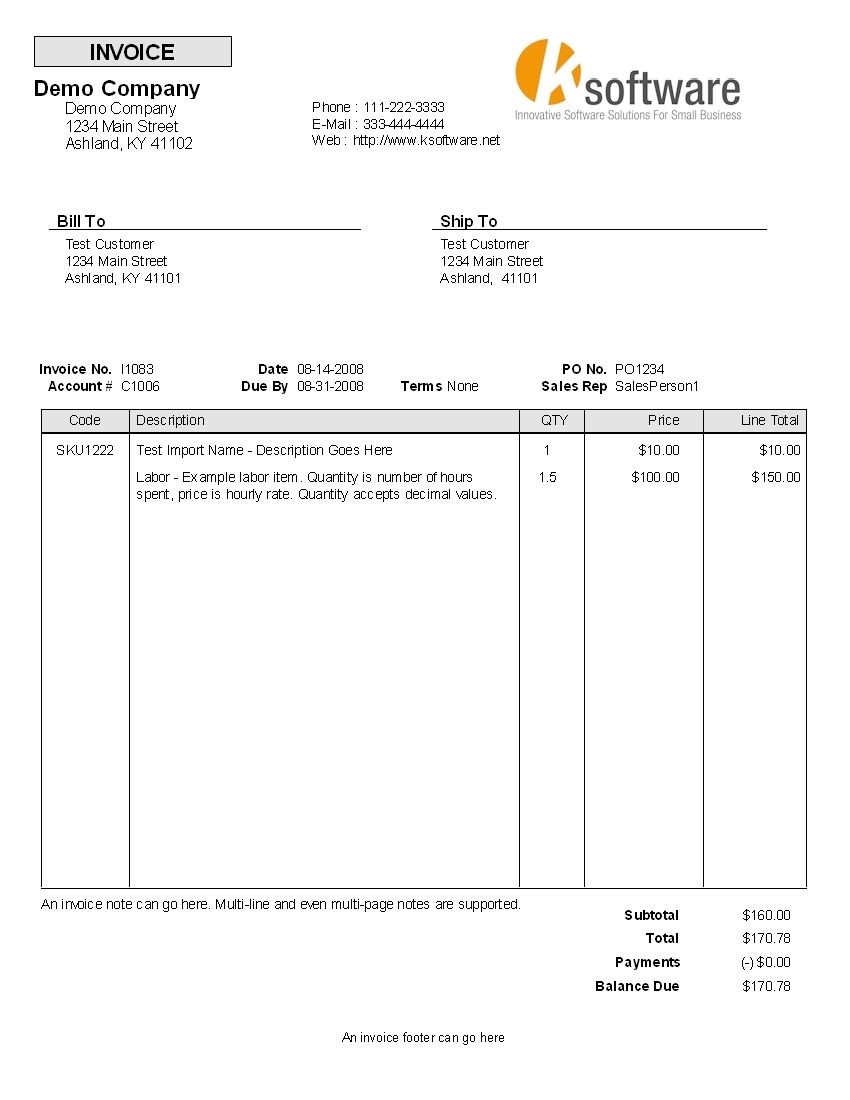

The result regarding fees on crack-also funding go back is actually demonstrated within the Desk cuatro. A beneficial $20,000 loan with an industry price regarding 7 per cent features an effective 7.5 % crack-even financing go back in the event the difference is contributed to an excellent 401(k). The vacation-also falls so you can 6.8 percent in the event that differences are invested in a family savings. If the a great $75 origination payment and you can an excellent $35 yearly restoration payment come, the break-also falls in order to six.step three per cent. Get rid of the mortgage add up to $2,000 therefore the split-actually drops to help you dos.cuatro percent. A variety of 401(k) mortgage charges and you may brief loan size dramatically reduces the beauty of 401(k) loans. step 3

Other Factors

Determining whether or not to obtain an excellent 401(k) mortgage concerns a peek at many other advantages and drawbacks relevant with the loans. cuatro Very first, there’s no credit score assessment having 401(k) finance, causing them to more attractive to individuals which have bad credit. As well, individuals with poor credit are generally charged large rates when trying to get a timeless financing; this isn’t your situation which have a great 401(k) loan. An additional benefit in order to 401(k) financing ‘s the ease of use. Basically, a primary form are published to the newest boss and loan payments try deducted regarding the borrower’s salary.

A serious downside is when a 401(k) mortgage isnt reduced, the new a fantastic matter is advertised towards Irs once the a shipments therefore the borrower must pay typical tax including a 10 % early withdrawal punishment in the event your borrower is young than just years 59?. The possibility of standard grows in the event of employment losses. That loan off a good 401(k) need to be paid off completely inside 90 days shortly after a career stops, or even the mortgage is within standard. And additionally, property during the old-age preparations is actually safe from inside the personal bankruptcy. People that may face bankruptcy proceeding want to avoid so you’re able to deplete safe possessions. A 401(k) loan try a negative option for anybody against work loss otherwise you can easily personal bankruptcy.

End

Whenever borrowing from the bank is actually unavoidable, a great 401(k) financing will be the most appropriate selection less than three problems. Very first, if the simply solution are highest interest rate debt, an excellent 401(k) financing will be the greatest alternative. A return to a leading rate of interest ecosystem similar to the early eighties tends to make 401(k) loans more attractive to all or any qualified players. Bank card or any other higher interest rate financial obligation will make 401(k) loans popular with some one saddled with this types of personal debt. Next, an excellent 401(k) mortgage is generally better when the expected funding yields was low. For instance, an individual having reduced-speed fixed income investments in his or her 401(k) could be best off credit the bucks to himself/herself using good 401(k) mortgage. Third, this new 401(k) loan is the sole option when you have poor borrowing or individuals who are liquidity constrained.

Good 401(k) loan is not the best selection less than multiple issues. The present day low interest ecosystem tends to make 401(k) money faster attractive. On top of that, having a good credit score and you can entry to home collateral financing enable it to be of https://paydayloanalabama.com/bay-minette/ several in order to obtain on lower pricing that make 401(k) finance quicker aggressive. An excellent 401(k) loan try a bad alternatives when the most other lowest-rate personal debt is obtainable. A great 401(k) mortgage is even a problematic selection whenever origination and you will repair fees are required additionally the amount to feel borrowed is actually short. Finally, borrowing from the bank outside a good 401(k) package was better when investment efficiency are expected as large or whenever borrowers can get dump its operate otherwise document personal bankruptcy.