That trick advantageous asset of jumbo fund in the Fort Lauderdale ‘s the exception regarding individual home loan insurance policies (PMI)

Fort Lauderdale, a neighborhood known for the scenic waterfronts and vibrant lifestyle, have a bona-fide home business very often need novel investment choices. Within this active business, jumbo loans are seen just like the a vital tool to own homebuyers and you can property people trying to meet or exceed the newest constraints away from conventional money.

Knowing the essence from jumbo finance starts with understanding the conforming loan constraints lay by the authorities-backed agencies such as for example Fannie mae and you can Freddie Mac computer. In lots of parts, these types of restrictions try adequate to coverage the average house purchase price. But not, in the Fort Lauderdale, where in fact the housing market comes with sometime highest average rates section, jumbo loans be a requirement.

While you are conventional financing often wanted PMI getting borrowers with a straight down commission lower than 20%, jumbo fund normally do not mandate it added cost, causing them to a stylish resource choice.

The latest Cutting-edge Home loan Process

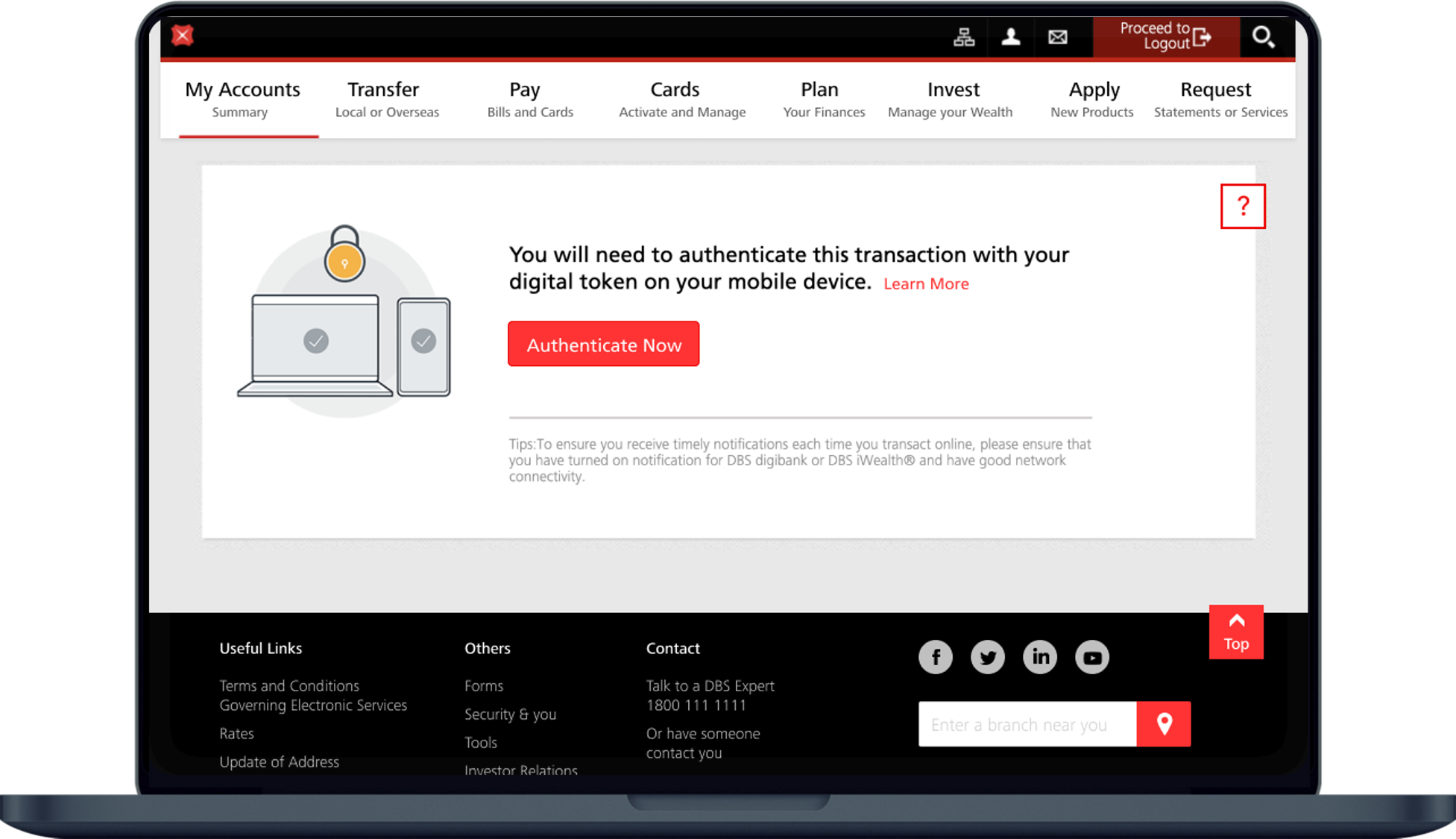

Securing a beneficial jumbo financing pertains to navigating a more complex financial techniques than the old-fashioned fund. Lenders examine a borrower’s borrowing from the bank, income, and you may economic information meticulously as a result of the higher risk of such money. And here the help of an experienced mortgage elite group becomes priceless.

Qualifying for good Jumbo Loan

So you can qualify for good jumbo loan inside the Fort Lauderdale, consumers you want an effective credit score, a steady income, and you can a substantial advance payment. Loan providers may have particular standards, and having a home loan elite group make suggestions from the qualification processes is crucial.

Percentage Choice: Fixed against. Adjustable Price

Jumbo loans bring borrowers self-reliance regarding fee solutions. You could potentially choose between fixed-rates jumbo mortgage loans, taking balances which have foreseeable monthly obligations, or choose for varying-speed jumbo finance, and this start by all the way down initial costs that may to evolve sometimes.

The brand new Fort Lauderdale Market

Fort Lauderdale’s real estate market is recognized for its range and you will charm, drawing of many consumers shopping for upscale qualities. Jumbo fund gamble a significant part obtaining such customers so you can see their hopes for running higher-well worth homes.

When navigating the brand new Fort Lauderdale housing market on intention to make use of a jumbo mortgage, partnering having an experienced real estate agent will be advantageous. Real estate professionals can help you discover qualities one line up with your resource wants. On the other hand, lenders when you look at the Fort Lauderdale will help you in finding new most positive conditions and you may pricing for your certain means.

An important benefit of jumbo fund is the ability to get or refinance highest-value features that meet or exceed antique loan limitations. They supply an advantage to licensed buyers through providing the required financial support and you may systems and come up with its home aspirations possible.

For these given jumbo finance from inside the Fort Lauderdale, the first step is to get in touch with your own bank or lender to own factual statements about the application form processes, rates of interest, and particular terms. Their bank offer beneficial details and skills towards jumbo mortgage characteristics they offer.

For those who have extra questions relating to jumbo financing within the Fort Lauderdale or you prefer more information on how they can benefit their real estate ventures, talking to a qualified home loan elite group is highly recommended. They can promote designed suggestions and you can assistance throughout the jumbo mortgage financial support software techniques, making certain you are really-advised and happy to make greatest economic behavior within surviving housing market.

Jumbo fund in the Fl play a pivotal part in catering so you can brand new diverse a house means for the sunshine county, away from active towns and cities eg Fort Lauderdale and you may Feet. Lauderdale so you’re able to lovely suburban section particularly Pembroke Pines and you may Pompano Beach, every set within Broward County. Inside the nations where the average home values surpass the newest compliant mortgage constraints, jumbo loans end up being very important to homebuyers and you may cash advance CT Old Mystic assets buyers the same.