Do you know the security getting mortgage away from 2019 ahead?

Related Questions

Determining security in the a property for loans relates to logical actions to ensure the asset’s really worth and legality. This course of action is vital to own mitigating dangers on the mortgage non-payments. Next facts outline effective suggestions for collateral testing centered on latest research. ## Equity Functions – **Resource Form of**: Only non-movable real possessions having valuable value is highly recommended. They must be without issues and not over-funded. – **Place and you may Classification**: Guarantee is always to if at all possible be found contained in this a certain radius in the lender’s office and you can categorized as basic property so you can helps much easier assessment. ## Analysis Methods – **Interior Assessment**: A structured interior appraisal techniques is very important, and standard working tips (SOPs) one follow appraisal requirements. – **Technical Application**: Implementing possibilities you to definitely familiarize yourself with equity analysis and you may notify lenders of anomalies can enhance the newest evaluation techniques. ## Exposure Assessment – **Vibrant Valuation**: Using shipping study to predict upcoming worth and you will threats on the moveable services can lead to more appropriate collateral assessments. – **Automated Computations**: Using their automatic options in order to calculate provisional equity beliefs centered on dollars move in place of profit speed can reduce clerical can cost you and you may boost precision. While you are these methods render an effective construction to possess equity assessment, pressures for example data accessibility and you can ripoff recognition are still vital issues that require handling to compliment the fresh new precision of one’s testing process.

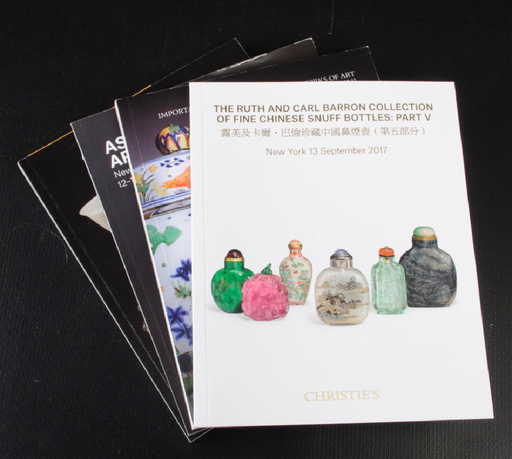

Notion regarding greatest cuatro papers The latest security to own mortgage loans keeps developed notably given that 2019, showing alterations in exposure government means, possessions valuation, and you may courtroom tissues

Older adults will exhibit much slower decision-and work out procedure and reduced accuracy as compared to younger some body . But not, age-related has an effect on towards creditworthiness can differ considering various situations. As an instance, relating to houses loans, marital reputation, number of dependents, borrower’s industry, mortgage objective, and you can interest levels all the gamble extremely important opportunities when you look at the deciding standard chance . On the other hand, the newest competency regarding small and medium-measurements of business owners, which is determined by decades, is proven so you’re able to significantly connect with business performance, to the ability basis being the really dominant for the operating team outcomes . Thus, if you find yourself age try one thing, almost every other borrower-related variables and you can additional economic variables plus lead notably for the creditworthiness out of an interest rate.

Age the fresh debtor is also indeed has actually a significant effect into creditworthiness away from an interest rate

Equity and gender significantly dictate credit standard within the microfinance. The absence of bodily collateral from inside the microfinance funds means MFIs do not believe in debtor assets to own fees, deciding to make the comprehension of default determinants important . Studies show one to men consumers are generally very likely to standard than just feminine individuals, a pattern noticed all over certain places and you can lending models . Although not, new perception out-of gender with the standard pricing may differ according to societal norms and you can structures. Including, women in patrilineal societies tend to have all the way down default rates opposed to the people within the matrilineal communities, indicating one to personal framework and gender positions play a critical character for the financial conclusion . Additionally, classification credit activities, which often include combined responsibility, reveal that organizations which have stronger social links (age.grams., friends and neighbors) have all the way down standard costs as opposed to those that have more powerful kinship connections (elizabeth.g., family) . Large groups and the ones with additional feminine people including have a tendency to have down standard prices, demonstrating you to definitely classification fictional character and you may gender composition was vital activities . The utilization of offers-credit elements and you may modern fund further assists with interested in reputable members, which have a notable emphasis on ladies’ empowerment, which can decrease standard risks . Server studying models, like XGBoost, have been proficient at predicting non-payments, demonstrating one to gender or other debtor features is actually high predictors . This new Covid-19 pandemic is served by showcased gender disparities, having women consumers in-group loans defaulting sooner than its men counterparts, even if overall standard pricing features reduced blog post-pandemic . For this reason, each other collateral and you can gender try pivotal during the skills and you can managing credit bad credit installment loans Wyoming standard threats inside the microfinance, necessitating designed procedures that consider these affairs .