We published a consultative file during the , to find feedback with the financial financing threats, particularly debt serviceability

Work of Superintendent out-of Loan providers (OSFI) might be using a loan-to-earnings (LTI) restriction to the portfolios away from federally managed financial institutions for new uninsured mortgages.

The fresh LTI restriction would be a simple supervisory measure that restriction highest quantities of family loans around the per institution’s uninsured home loan loan collection.

- It can act as good backstop into the Minimum Qualifying Rates (MQR), such for the symptoms from low interest rates.

- It will not apply at individual borrowers.

- This will help to us improve all of our mandate out-of protecting this new legal rights and you can appeal away from depositors, policyholders and you may standard bank creditors.

What we should heard

https://cashadvancecompass.com/loans/payday-loans-with-prepaid-debit-card/

We detailed that people regard LTI and you may Obligations-to-income (DTI) just like the smoother measures that’ll restriction large amounts of home debt within a profile peak. So it mitigates obligations serviceability risks of the so much more personally addressing the underlying vulnerability.

OSFI also known as aside this problem within its partial-yearly revise to their Annual Risk Mind-set. When it comes to those courses, i noticed you to more Canadian loan providers keeps some other chance appetites having novel organization models for the a very competitive home loan business. Thus, a simple, macroprudential LTI level may possibly not be fit-for-goal inside the Canada.

Results

According to research by the appointment views, OSFI altered their method of loans serviceability. We have been swinging out of an effective consistent, policy-based LTI limitation that might be practical over the business, so you can a more nuanced and you will tailormade method on just one FRFI-level. As a result all of our guidance changed regarding good macroprudential to a beneficial microprudential implementation.

Purpose

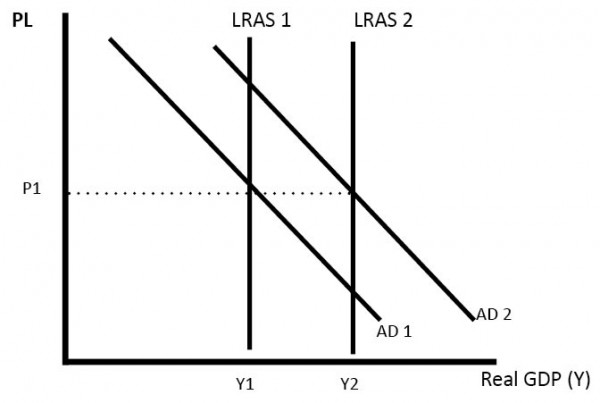

Highest household loans is still connected to borrowing from the bank exposure, the safety and you will soundness off FRFIs, therefore the total balance of one’s economic climate. High LTI funds started in the low interest rate cycles have created an extended-identity vulnerability into Canadian economic climate. OSFI’s LTI construction will help end the same accumulation out-of financing into instructions supplied to extremely leveraged and you will indebted consumers about future.

Whereas each other debt services proportion restrictions in addition to MQR endeavor to target obligations serviceability, this new measure will act as good backstop and offer a good simpler precautionary size. This build tend to synchronous the brand new method to money in the Basel III structure.

The new LTI limitation design was designed to allow organizations to keep up their same cousin aggressive ranks on the market. Quite simply, OSFI’s LTI restriction structure is actually proportionate for the other company activities contending to have Canadians’ mortgages.

Proposed build design

Brand new size might be appropriate for new originations at the collection level, perhaps not to have private individuals. For the a great quarterly base, for each business should assess the portion of the recently started funds one go beyond the brand new cuatro.5x mortgage to earnings multiple.

While which cuatro.5x numerous was well-known across the all the associations, this new portion of the brand new bookings and is permitted to meet or exceed that it numerous would-be unique to every business as well as unique aggressive model.

Restrictions

Limits would-be derived having fun with an everyday and you can idea-situated means. Specifically, the annals out-of higher LTI originations trend is actually examined during the individual establishment top. The brand new construction considers both the age of low interest, as well as the more recent origination styles under the higher interest environment.

Range away from financing

To prevent the fresh buildup out of leverage of the cracking money to the smaller components from the some other associations, all the loans shielded against the subject possessions are essential is inside range:

- basic and you can next mortgage loans, HELOCs, and other borrowing from the bank vehicles;

- men and women kept of the same or a new facilities;

- long lasting implied utilization of the possessions (owner-occupied otherwise money spent for rental).

Qualifying money

Total qualifying income according to research by the institution’s meaning are going to be applied. This will make into logic used to assess loans provider ratios.

Rationale

OSFI even offers presented quantitative acting exercises to evaluate various other possible architecture toward growth of the fresh limitations. Yet not, despite a life threatening upsurge in complexity of your own approaches, this new resulting constraints was in fact into the-range with this particular basic means.

Execution

The brand new LTI scale is expected for taking effect at the time of each institution’s particular fiscal Q1, 2025. Immediately after accompanied, OSFI commonly anticipate quarterly compliance revealing.