Real estate loan Constraints Traditional, Va, FHA Home loans

Nearby Areas

One another Lime State and Los angeles State features a super compliant loan maximum off $step 1,149,825. Imperial, Riverside, and you may San Bernardino Areas have a loan restrict from $766,550.

Just how Old-fashioned Mortgages Work

A compliant otherwise very conforming mortgage pursue Federal national mortgage association and you may Freddie Mac advice, which allow the lending company to offer your financial on discover sector. Who is Federal national mortgage association and you may Freddie Mac, and so what does the new secondary home loan market pertain to it?

Home loan Backing Federal national mortgage association and you may Freddie Mac computer

Federal national mortgage association (FNMA, and/or Fannie mae) and you can Freddie Mac computer (FHLMC, or even the Federal Home loan Home loan Corporation) are financial functions corporations dependent of the Congress, labeled as authorities-backed organizations (GSEs). They certainly were intended to give the new circulate out of borrowing, which tends to make owning a home open to far more Us citizens. They do this through a holiday home loan market, and this boosts the supply of currency available for home loan financing.

How it functions: Just after loan providers generate a home loan purchasing or refinance a home, Federal national mortgage association and Freddie Mac buy the financial on lender, and so the bank have extra cash to help you give away for another financial. Fannie mae and you will Freddie Mac computer take the mortgages he’s got purchased, pond all of them, then promote them once the mortgage-recognized bonds towards the open market. They do this more often than once.

This is why the latest second financial industry escalates the source of currency designed for mortgage loans: individual traders provide earnings to have banking companies to continue so you can lend money. To learn more about the new 2007 home loan safety meltdown, and that developed the 2008 international overall economy, check out this Investopedia article.

Compliant Mortgage loan Limits

Today, Federal national mortgage association and you may Freddie Mac computer straight back around 60% of all the mortgage loans in the us. Nonetheless wouldn’t get just people mortgage; it set legislation to help you limit the risk of property foreclosure. A conforming financial is the one that pursue Fannie mae and you can Freddie Mac direction. Most loan providers abide by these guidelines to allow them to sell their property finance into the supplementary home loan sector, and take those funds and work out a lot more money. One guidelines is the restrict number of the mortgage, and/or conforming home loan limit.

The latest Government Houses Fund Institution (FHFA), with monitored Federal national mortgage association and you will Freddie Mac computer since 2008, posts yearly conforming mortgage constraints. The borrowed funds restrict count hinges on the type and you can place regarding the house or property. The newest constraints try analyzed from year to year from the Housing and Monetary Recovery Work (HERA), consequently they are according to the FHFA’s Construction Rate Directory (HPI).

At the time of , the fresh mortgage limit having mortgages getting single family relations characteristics inside the Hillcrest Condition try $step one,006,250. That is $twenty-eight,750 more than the fresh new 2023 limit of $977,five-hundred.

Antique Jumbo Mortgages

Financing that meet or exceed financial limits have been called jumbo mortgages. Jumbo mortgage loans usually have stricter underwriting conditions, and can even involve large off payments, large rates of interest, and higher costs. It is also more difficult to refinance jumbo home loans.

FHA Real estate loan Limits

Money that are secured or covered by the Government Casing Government (FHA) also provide real estate loan restrictions. Although the FHA isnt linked to Fannie mae otherwise Freddie Mac computer, they often use the same mortgage limitation numbers.

As of , the fresh new financing restriction getting FHA mortgage loans to possess features for the San Diego State are $step 1,006,260. To check the maximum away from San diego County, you can check new FHFA set of 2024 compliant loan restrictions.

FHA home mortgage restrictions vary commonly, as low as $766,550 for the majority elements, and as high due to the fact $step 1,149,825 in other parts.

FHA Jumbo Mortgage loans

If you prefer a loan you to is higher than the borrowed funds financing restriction, jumbo mortgages are available to FHA individuals. Just as in traditional jumbo mortgage brokers, you’re necessary to provide a bigger down-payment, and there are more strict underwriting conditions.

Va Home loan Limits

Energetic , there are no home loan restrictions to possess funds that You.S. Service from Pros Affairs (VA) makes sure. The latest plan try composed into Blue water Navy Vietnam Veterans Work out of 2019. Because of this whenever you are there aren’t any home loan limitations, how much a borrower normally obtain varies according to their lender’s certification.

The bottom line

Of a lot home buyers within the North park County have to borrow way more than the superconforming home loan restriction, hence needs a beneficial jumbo mortgage. Inside Carlsbad, such, an average conversion process rates to possess a separated house for the was $step one,600,000 nearly $600,000 greater than superconforming home loan restrictions. Speak to your lender to discover the best mortgage program for you.

Into the 2015, the user Monetary Defense Agency create an excellent toolkit to compliment people from process of looking for a home loan and purchasing good house. The house Financing Toolkit was a good tool so you can bundle you buy.

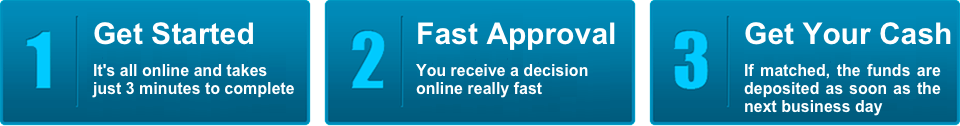

If you find yourself thinking about purchasing property, or refinancing your existing domestic, you could hear about where you are able to go to get home financing, the way to get financial preapproval, and how far a loan provider will allow https://clickcashadvance.com/personal-loans-or/ you to acquire.

You may also learn about conventional lenders, Va Home loans, FHA Lenders, Downpayment Advice Software having North park Condition home buyers, and you may Home loan Recovery Applications to possess most recent San diego County residents. Get in touch with me having questions.