My personal earliest domestic was a student in a cellular house playground

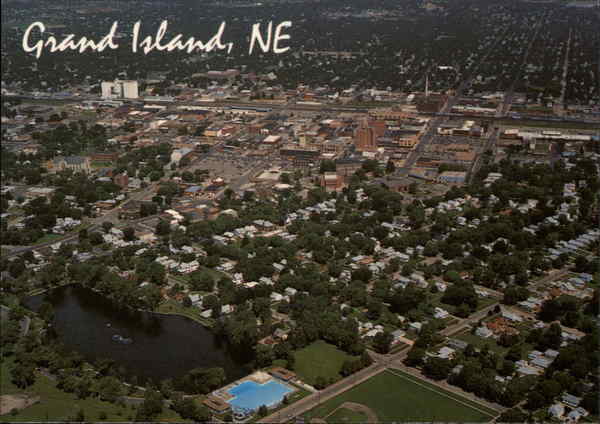

Long ago, my first domestic is a cellular house inside Calgary’s Greenwood Village cellular home park, call at new northwest the main city. It absolutely was in reality a nice park, plus the hills was apparent, and many towns to walk our very own dog. All of our earliest residence is one in the centre of your own picture, as well as the nothing missing I depending has been status out straight back. It absolutely was an effective home.

New facts leading up to this new cellular family buy was three fast lease upsurge in lower than a-year from your property manager on the a small shack during the Calgary’s now most popular Western Hillhurst area. I drove by that absolutely nothing shack on Westmount Push a number of weeks hence, and it is nevertheless there get together lease. Really don’t think something has changed since i stayed here twenty five years ago! In the past, one little family try worth on $60K. Today, this new package by yourself will probably be worth $600K together with characteristics left and you will best $1M a piece! Which is called rates like, and it’s a robust force in running a residential property. At the same time, proprietors out of Greenwood Village are also cheerful cheek-to-cheek. He has got mobile property owners pay them package book for a long time and you can age, in addition to their belongings is now really worth a fortune – that is how it works. We in the near future pointed out that if we wished some speed really love possible, that individuals can purchase things in which we possessed the fresh new home. Therefore we protected a deposit for a lot of many years and you may ordered a tiny cottage in the Calgary given that the 2nd family. Since it identifies to this analogy, we reduced $22K for our nothing mobile from inside the 1988 now, it would be worth about the same. Concerning all of our second house, new bungalow, we reduced $130K within the 1992 and also in 2015 you to definitely same house was really worth

Commonly consumers try interested in are built homes for the cellular family groups by detected cheap in line with a vintage household to the a had-lot. Just what consumer doesn’t thought is that including new month-to-month loan commission towards the mobile, there is also a monthly lot lease percentage to the playground government perhaps in the near order of $400-$500/times otherwise morebine both payments, and it’s really in reality charging as frequently or even more per month than home financing commission to the a small household.

The other day I got a trip out-of two searching from the to shop for a more recent are available household to your a rented parcel for the a playground within the a smaller sized Alberta area exactly as i performed all these in years past, and thinking exactly what solutions they had for a mobile home loan

“Hey someone, I did specific math to you personally past. Financing to own an excellent $175K cellular house from inside the a playground would have a $715/mo payment (4.64% twenty-five 12 months Was, $35K down-payment), including $350/mo park payment = $1065/mo having property. Just remember that , – once you you should never very own the fresh land – the speed are high (named an equity financing). The fresh monthly park leasing commission goes straight to the new park proprietor.

I decided not to qualify for a home loan in the past to have explanations We didn’t learn, so we purchased having $22K with some assistance from the financial institution from Mommy & Dad

Out-of attraction, We computed in reverse to see what home value a comparable $1065/mo do get. The clear answer was an excellent $290K house or apartment with $35K down will have a comparable $1065/mo commission. In this instance, you might very own real estate, that’s an appreciating house. About 50 % of any payment might be paying the fresh mortgage equilibrium monthly (i.e. you are able to pay off $30K in 5 years vs $12K repaid on mobile home loan).