What to Envision Just before Including People to Your Mortgage

Step 3: Look at the Fees Inside

Except that getting an appropriate angle, you will be thinking about the fees doing work in incorporating people so you can home financing. Capable through the Early Fees Charges (ERC), Stamp Duty tax, and you may registration costs.

That said, you can examine simply how much ERC you can accumulate throughout the last mortgage statement otherwise repayment you done. If no credit check installment loans Richmond it’s high, you may need to reconsider that thought remortgaging, regardless of if your current lender won’t put the lover’s title so you can the present day home loan.

Step four: Contact your Current Financial

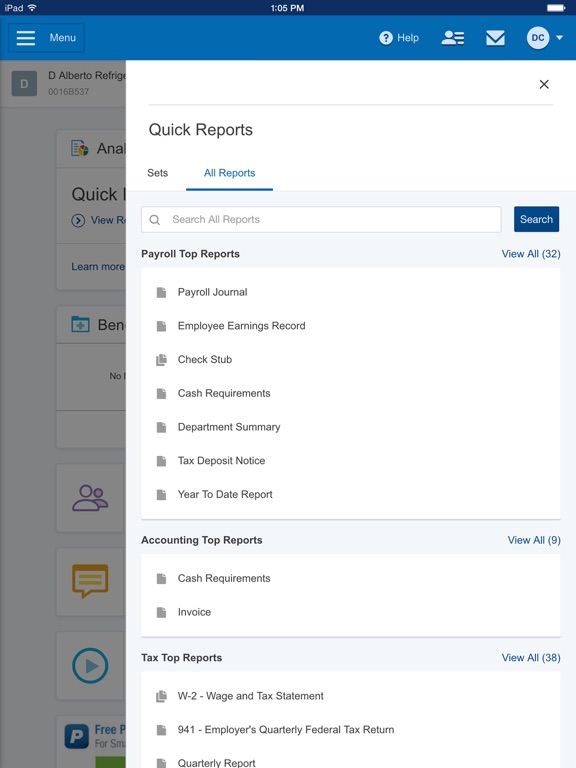

Once you have settled the newest ending up in their solicitor and potential home loan lover and you will felt all fees, it is the right time to strategy the lending company. Get in touch with them and inquire if it’s you’ll to add you to definitely the mortgage.

Require the expenses inside it as well. Particular lenders offers a joint home loan account for 100 % free, but it is best to predict the contrary. If every happens really, your own lender will give you the latest all the-clear to incorporate title and you will send you the application form files.

Nevertheless, you to definitely however cannot prove new inclusion. The lender nonetheless has to determine your partner’s qualifications with the home loan. They will have to go because of their ID, borrowing, and you may income guidance ahead of approval.

After approval, it’s formal. Or even, you may not obtain the mutual deal, since your lover’s credit rating otherwise money standing will not qualify for the borrowed funds. Subsequently, move to the next thing.

Step 5: Get a hold of A mortgage broker

Today, in the event the ERC costs are too far or your bank rejected the consult, you’ll find a mortgage broker. They will browse from mortgage market to get a hold of the finest lender for the items.

The fresh new broker will assist you to decide which choice is far more cost-effective. In many cases, they could tell you firmly to spend the money for ERC in place of remortgaging. It is all situation-by-situation.

Action six: Complete the Courtroom Really works

After interacting with a contract, your solicitor commonly deal with brand new legalities. They’re going to help you undergo any offer you’ve decided, like a joint-tenant otherwise tenants-in-common problem. And additionally, might manage the house or property ownership predicated on the choice.

Prior to going completed with incorporating someone to their mortgage, you will need to believe a few items, such as the ERC and you can association off credit.

Early Payment Charges (ERC)

The latest ERC is a critical basis worth considering before choosing good type including people to your own mortgage. Borrowers was at the mercy of the ERC once they get-off the financial very early.

For those who pay off over the thing that was decided, their financial manages to lose upcoming interest rate repayments. And come up with up for this, the ERC comes to play.

The fresh charge can vary between step one% to help you 5% of your number you nonetheless still need to pay off. The fresh commission is at some point around the lender and exactly how enough time you’ve been using them.

The sooner your try to log off the loan regarding the most recent financial, the greater we offer the newest ERC. Therefore, if you find yourself however at the beginning of the mortgage, you should select the very first strategy and you can speak to your lender on including someone to the offer.

At the same time, when you are nearing the termination of the newest fixed label, it will be well worth taking a brokerage to find elsewhere getting a much better plan.

Borrowing from the bank Relationship

While you are remortgaging to help you a mutual contract, you’re going to have to consider the connection out-of credit. An association from borrowing connects your partners’ credit score.

Mortgage brokers typically make use of your credit report to evaluate your eligibility for a loan. The low their score is actually, the greater number of lenders will have to envision before entrusting you having a large share.