MCPF provides a binding agreement having Standard bank Your retirement Driven Construction Loan (PBL) confirming surety on the behalf of all of the MCPF participants

Construction Loans are supplied with regards to Area 19(5) of your own Retirement Money Act, Zero 24 out of 1956 thanks to Lender regarding Southern Africa and you may every software having houses finance was cared for from the lender in terms of the Federal Credit Work (NCA), No 34 away from 2005.

Pension Supported Credit product (PBL) offers an alternative way for your organization to greatly help team so you’re able to fulfill its construction need. That have a pension Recognized Financing home loan, group is also funds their houses of the leveraging the deals he has gathered within their old age fund.

With negotiable month-to-month costs and a prime connected interest, your workers possess usage of housing fund one to costs the latest same if not below mortgage-backed finance, that doesn’t include thread registration or possessions valuation will cost you and you will doesn’t believe the business worth of the house or property worried.

Your business are now able to increase staff better-getting and gratification, and build commitment with no influence on your debts sheet and you may minimal effect on peoples funding management.

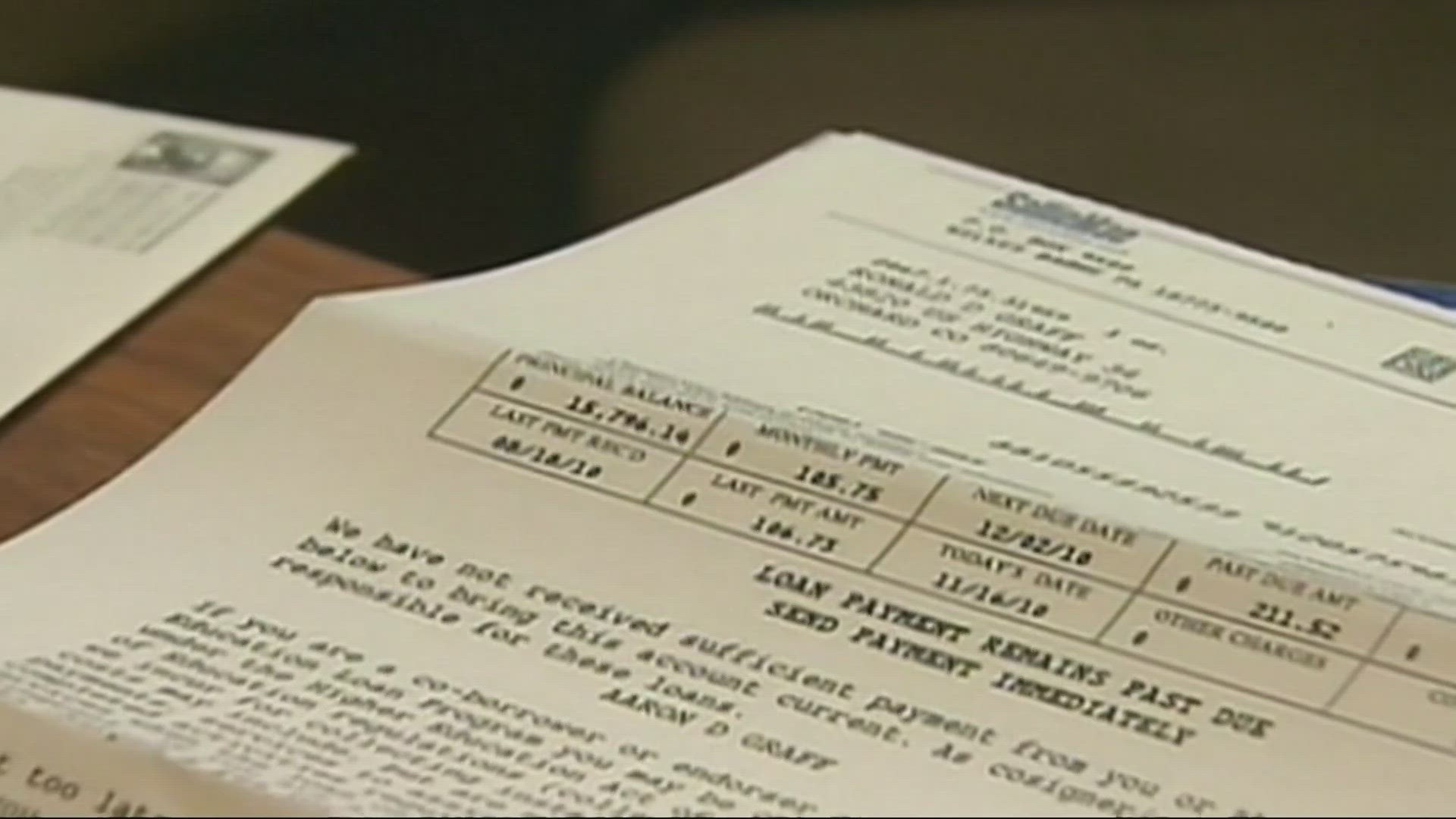

Its Users & Municipalities’ responsibility to adhere to the agreement to ensure this new payments try subtracted and you can reduced in order to Financial institution.

33% of the member’s user express is supplied just like the a hope because of the the brand new Loans to Lender. In the event the an associate features R100 000 user show this means that the respective representative might get an optimum mortgage of 33% which equates to R33 333 on conveyed scenario. https://paydayloancolorado.net/holyoke/ The newest readily available 33% out-of member share are different according to private worth of user share

Which then ensures that an associate should accumulate a member display off R15 000 to help you qualify for that it work with.

Should an associate utilize this business instance inside the 2nd season into the place of work, their mortgage is still determined over an excellent 5 season several months. The new member should make costs into the remaining 36 months inside workplace of these particular name. If the user become re also-decided to go with on the workplace from the the brand new name the remaining costs often getting gone to live in the original couple of years of the the latest term.

Should a member never be re also-chose immediately following their very first title meaning that simply reduced 36 months the rest amount becomes deducted on the Member express prior to the fresh professionals searching their cash.

Each municipality should complete an undertaking on the part of the their Councillors who will be part of MCPF verifying your local government agrees to help you deduct the latest money prior to people researching its wages. This starting have to become returned to Lender Retirement Powered Casing Finance just before its people utilizing this studio.

Because aforementioned performing could have been obtained from the Financial institution PBL participants can get the housing money. The new done forms together with the help records should up coming end up being sent to your relevant Standard PBL work environment.

Standard bank PBL Application for the loan standards

- Players to do a keen Application form and Money & Expenditure in full

- Participants to add copies of your own after the: Duplicate regarding ID document Duplicate of ID file off companion if hitched in community regarding assets Agree letter of companion when the married into the community regarding property Proof of home-based address perhaps not over the age of three months ninety days Payslips 3 months Proof of banking info Later years Financing representative work for declaration Quotation away from procedure when the improving/renovating/strengthening or Promote to order if the to buy a house otherwise vacant homes The significantly more than to be faxed to 011 981 8885 / 011 981 8812 or emailed to

Immediately after Financial institution PBL obtains the job, the process is as follows:

- Representative applies to Lender PBL to own loan.

- PBL vets application for affordability and you will conducts NCA checks.

- App successful users told and you may application handed to Pleasure Experts

- Satisfaction Agent suits which have member and performs a part understanding i.t.o. NCA debtor and you will user indication the mortgage agreement

- Mortgage agreement gone back to Lender and you may sent to Fund having consent and you can list flagging

- Loan arrangement gone back to Lender performs a last see and will pay away the loan so you’re able to affiliate.

- In case your loan is declined for whatever reason user told of the Texts