Concern Three: Whenever can be consumers initiate enjoying the masters?

All over the country, which group regarding rates incisions can benefit 50 billion domiciles and you will 150 million somebody, reducing house interest expenses of the on average 150 mil RMB annually.

Gurus believe that the rate clipped to have existing property finance often assist consumers after that lose the mortgage interest expenditures, increase user readiness to expend, balance homebuyer traditional, while increasing confidence.

Existing construction financing individuals will be able to take advantage of the pros of group changes by the Oct 31st on very first.

With regards to the “Initiative,” industrial banking institutions are expected to equally incorporate group adjustments so you can present houses loan costs by October 31st.

Reporters have learned one to Commercial and you will Commercial Bank out of Asia (ICBC) will make sure the completion off group changes from the October 31st, if you’re Farming Lender regarding China (ABC) tend to apply consistent batch customizations just before Oct 31st.

Matter Five: What actions would individuals need to take?

Journalists have discovered you to definitely big industrial banking companies are generally needed to discharge detailed operational assistance no afterwards than just Oct 12th to handle buyers inquiries on time.

In the , Asia conducted a batch adjustment off property financing costs. Very industrial financial institutions fulfilled brand new improvement means away from people because of on the web channels particularly on the internet financial and you may mobile banking with an excellent “one-mouse click procedure” process, rather than requiring people to do additional cutting-edge surgery traditional, ultimately causing a silky consumer feel.

Concern Four: Exactly how commonly the newest improvement from existing houses mortgage rates towards other repricing dates getting handled?

Due to the fact per borrower keeps a unique mortgage repricing time, this new costs for different borrowers are very different after the batch modifications.

Experts imply that the key reason for the rate fall off immediately after the fresh new batch modifications is actually a decrease in the latest markup rate so you can -29 foundation issues. not, immediately after repricing, the speed reduction of the newest cost period of Loan Perfect Rate (LPR) might also be mirrored. Individuals engaging in that it group changes get its rates modified to your same height.

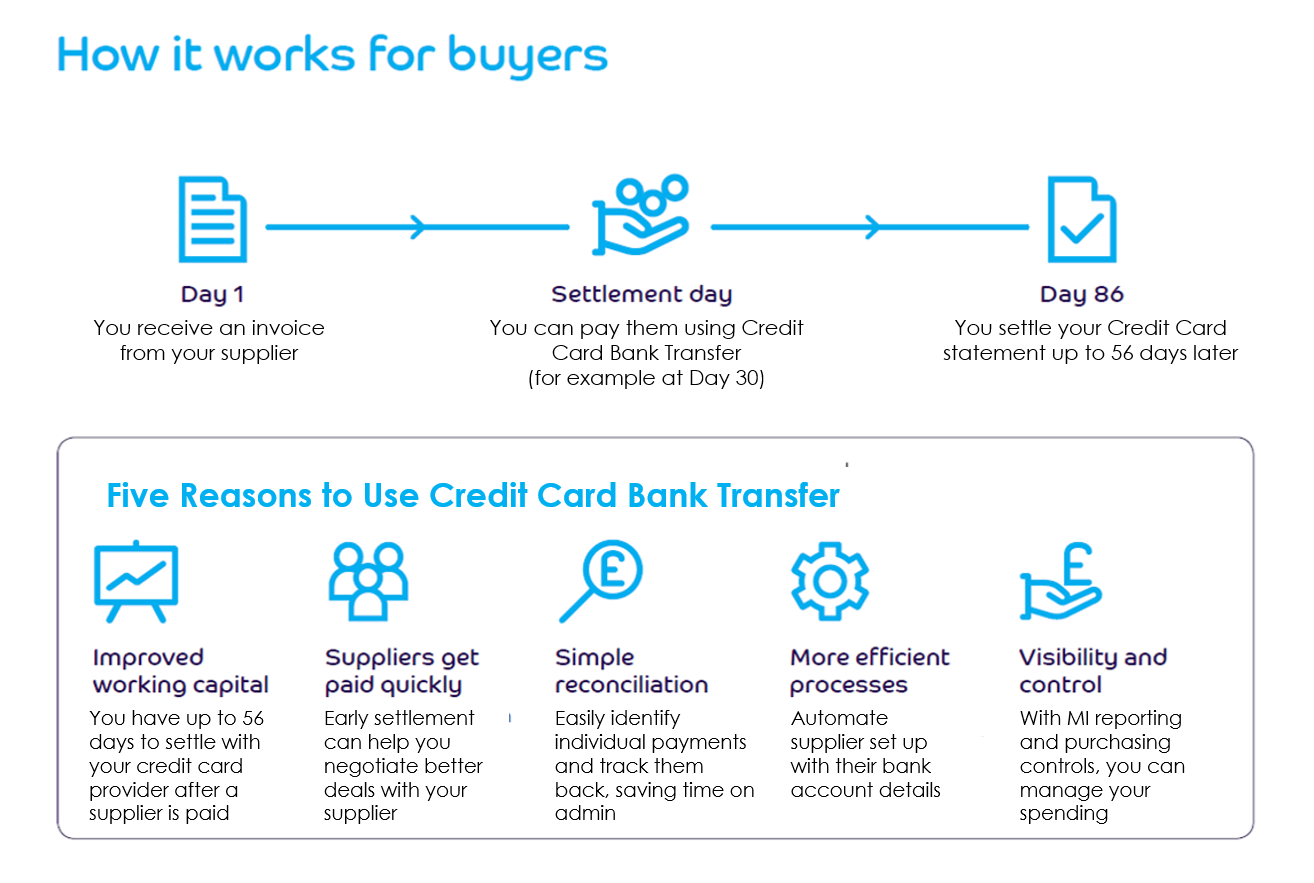

Consumers with assorted repricing schedules is also consider the following desk to decide paydayloancolorado.net/mountain-view their particular present housing financing rates changes condition.

Eg, and when a batch improvement into the Oct 31st, towards most recent 5-season LPR by October twenty-first after the main lender policy rate decrease by the 0.2 commission points, shedding regarding the current step three.85% to three.65%. Since 5-12 months LPR has decreased from the a total of 0.thirty five commission products for the February and you may July in 2010, getting existing homes funds repriced with the January initial, the speed following this group variations would be step three.9% (determined based on a beneficial 4.2% LPR), plus the speed adopting the repricing of LPR on the January first next season is step 3.35% (determined predicated on a beneficial 3.65% LPR).

Matter Six: Just what preparations can be found in location for the brand new a lot of time-name method?

Journalists have learned this may be the last group adjustment out of established property mortgage costs in ChinaIn the near future, Asia will determine a lengthy-name method with the slow and you may prepared variations from established homes financing interest levels.

“Since the title off property financing agreements are much time, a fixed markup speed dont echo alterations in debtor credit, business likewise have and demand, and other facts. Just like the industry condition transform, it isn’t difficult towards the interest rate differential ranging from the newest and you can old casing financing in order to broaden.” Another official on main financial reported that its wanted to optimize the brand new institutional design so you’re able to assists industrial banks and you can borrowers to modify agreements from inside the the right styles.

To address one another instant and you will fundamental affairs and you can sooner solve the newest problem of interest rate differentials between the brand new and you will dated property financing, new main lender will establish a long-identity procedure into the gradual and you will orderly modifications from current property loan interest levels.