Must i utilize the leasing money away from a 2-to-cuatro unit to obtain home financing?

- $nine,900 x 29% = $step 3,070

To own analysis, in the event that Ada would be to buy an apartment, the absolute most she you are going to be able to purchase monthly might possibly be $2,325. Without the rental earnings, extent Ada is obtain minimizes considerably.

Due to the fact A beneficial-a great is interested in a multiple-family home, the long term local rental earnings increases their particular to acquire fuel, enabling their own to borrow a whole lot more along with her mortgage.

When purchasing a 2-to-4-device home, you need tomorrow rental income regarding property in order to help you qualify for the loan. Still, the principles vary with regards to the version of financing you employ.

FHA loan: The lender could add up to 75% of lease you expect to receive with the qualifying income, and also make providing recognized with the loan smoother. Such as for example, pick a beneficial duplex, therefore the rental device stimulates $step one,000 monthly. This is why, you can include $750 toward month-to-month being qualified money.

Conventional mortgage: Simultaneously, the lender could add around 75% of rent you would expect to receive towards the qualifying earnings. not, you will find one tall restriction – you must have a primary way of living expense, such as a mortgage or book fee.

The financial institution commonly find out if you’ve made construction repayments for on minimum 1 year just before letting you play with coming leasing earnings regarding dos-to-4-unit property whenever being qualified to the home loan.

The second desk reveals whether or not you can include a fraction of the future local rental money out of a 2-to-4-tool possessions into qualifying money to help you get acknowledged to have a conventional loan.

Learning how much a multiple-family assets can cost you was a vital initial step into the property. To invest in a home needs more than just the monthly homeloan payment. In advance of definitely offered to order a multi-house, you’ll need to influence the degree of your down payment, closing costs, and monthly premiums.

To possess consumers, financial costs are tend to broken down toward several broad groups: the monthly payment and your dollars to close off. Dollars to close off refers to the down payment and closing costs due when you personal on your domestic. Their payment comes from the lender per month once the you pay the loan.

To acquire a multiple-home, you need step 3.5% of loans for 400 credit score your cost for the down payment. You can easily spend the down payment towards seller since you romantic on the this new possessions, and also the left level of the price is what you use off a lender.

If you buy a great step 3-flat for $five-hundred,000, need $17,500 for the down-payment, that’s 3.5% of your price. Following, use $482,500 of a lending company including newcastle.financing.

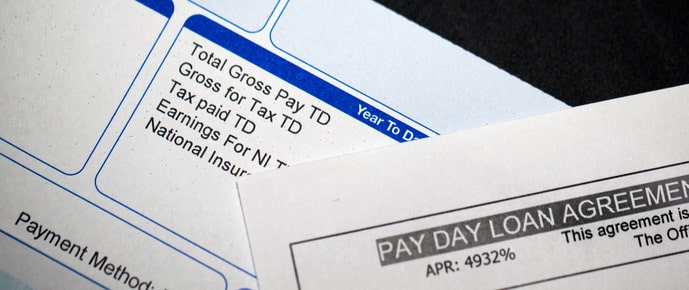

You cannot borrow funds to pay an advance payment or take out a cash loan away from a credit card. Generally, if you fail to prove where you got the money, the lending company wouldn’t amount they into the the money you’ll want to intimate with the domestic.

Are you willing to book, very own, otherwise real time book-totally free?

And the downpayment, closing costs are the charges you only pay when selecting a house. Although other fees fall into so it umbrella, you ought to anticipate brand new settlement costs in order to range from 2-5% of the cost.

Seeking upcoming local rental money to own a traditional financing?

After you as well as your realtor discuss your sales contract, ask the vendor to invest some otherwise all your valuable closure will set you back. While you are providers can be willing to security this type of settlement costs, they cannot pay people a portion of the down-payment.

You want supplies when purchasing a house with step 3 otherwise 4 systems. Supplies are loans you have left-over shortly after closing. Typically, loan providers want 90 days of your housing percentage during the set-aside having unforeseen openings, solutions, otherwise can cost you your incur since the a special proprietor.