FHA and USDA financing you would like particular files to possess approval, like an enthusiastic ID, shell out stubs, and you may tax returns

While confronted with the choice of whether or not to fit into a beneficial USDA financing or an enthusiastic FHA mortgage, it will will feel a hard options. However some of criteria could possibly get convergence, you can find trick distinctions you to place all of them other than one another.

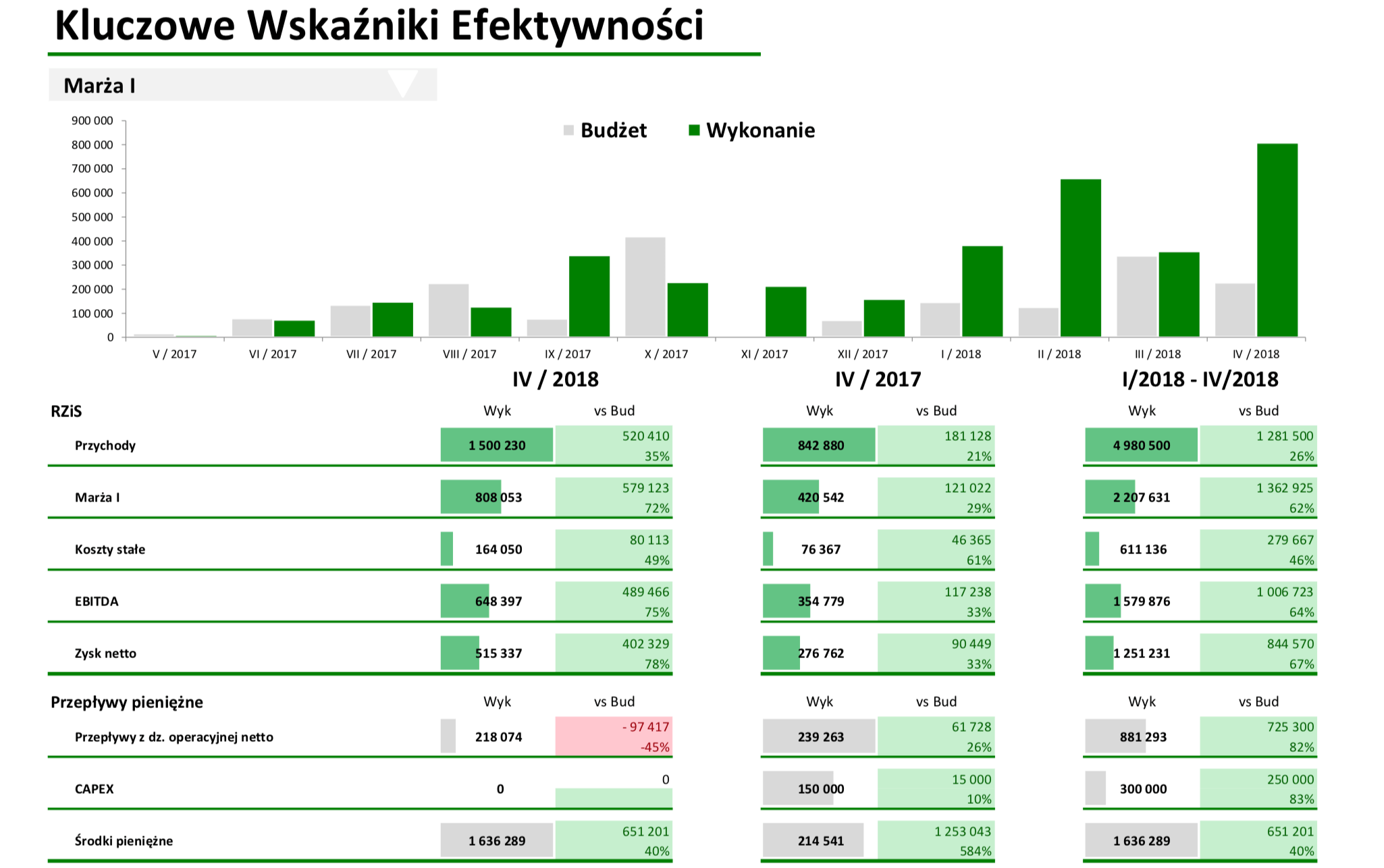

To comprehend the differences ideal, take a look at table offered lower than. It features many situations you must know when comparing USDA compared to. FHA funds.

Why don’t we mention this new details of several activities and you may learn things when that mortgage type was so much more advantageous versus most other.

Financial Approval Procedure

Thought bringing mortgage pre-approval to suit your FHA or USDA financing in order to speed up this new procedure. Despite preapproval, it may take 29 so you can 45 days to end the loan and you will personal with the family.

The fresh USDA mortgage processes could well be longer than an FHA financing just like the USDA financing proceed through twice underwriting-basic from the lender right after which by USDA.

Your house must proceed through an appraisal by one another USDA and FHA to guarantee you are purchasing a reasonable speed, however, USDA money skip the house examination action .

FHA funds come with their band of conditions which will continue the schedule. Their financial requires an appraisal and you will evaluation of an enthusiastic FHA-acknowledged appraiser ahead of closure.

When you romantic, you’re anticipated to transfer to the house within this two months and real time truth be told there as your main household for around a-year. Failing woefully to meet these types of criteria can lead to legalities.

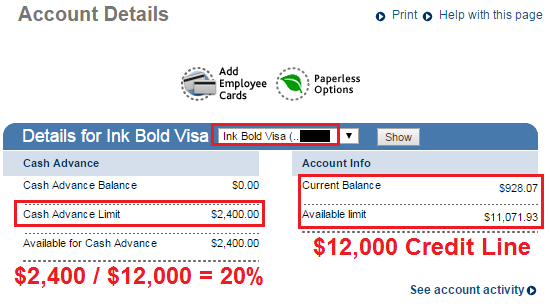

USDA and you may FHA finance are meant to assist consumers whom can get find it difficult to meet up with the down payment needed for regular funds. USDA loans dont call for a downpayment. Yet not, if you create a down payment , you will probably reduce your monthly home loan repayments while the interest towards the mortgage.

For an enthusiastic FHA financing, with a credit rating anywhere between five hundred so you can 579, a downpayment of at least 10% of your residence’s price required. In case your credit history is 580 or higher, FHA mandates a minimum step 3.5% down-payment. Exactly like USDA financing, a much bigger advance payment could lead to lower rates of interest and you may month-to-month mortgage payments .

Financial Insurance coverage

Mortgage insurance policy is included once you submit an application for sometimes a keen FHA otherwise a good USDA mortgage. But not, extent you pay having mortgage insurance can differ considering the program you decide on.

To possess FHA fund, the mortgage insurance costs are highest than the USDA funds, specifically if you create a smaller advance payment. For individuals who put the minimum step 3.5%, your month-to-month home loan insurance premium would be 0.85% of one’s amount borrowed. It premium should be paid off regarding the whole mortgage name, and the upfront payment of just one.75%.

Regarding USDA funds, the mandatory premium, referred to as capital fee, do not meet or exceed 0.5% of your remaining equilibrium and you may step three.75% upfront. You may be expected to spend the money for month-to-month advanced to the whole label of one’s USDA financing.

Money Standards

If you’re considering an enthusiastic FHA financing, your income is not a determining get a loan with no credit Vernon grounds. There aren’t any specific earnings limitations, but you need have indicated a stable money that may safety your own mortgage. Generally speaking, you will have to let you know tax returns, spend stubs, and you may works confirmation during the app process.

To the USDA financing program, you’ll find income restrictions. Your income ought not to meet or exceed 115% of one’s mediocre money in your part. Just like the lifestyle will set you back and you may wages disagree all over states, particular elements enable it to be high earnings thresholds. You could potentially be certain that your own qualification predicated on your location through the USDA’s web site.