How-to Assess Your house Security Personal line of credit

Consider it by doing this: You reside more likely the most expensive purchase your is ever going to create. It will be your own best resource. Shopping for ways to supply their home’s worth (otherwise tap this new security) now offers several advantages.

Probably one of the most flexible units having opening the worth of you reside a home equity line of credit (HELOC). A beneficial HELOC lets you make use of your household security since rolling credit, giving you usage of cash when needed, just like credit cards.

What is property equity line of credit (HELOC)?

As term indicates, a house equity personal line of credit are a line of credit offered up against your own residence’s worthy of.

Why does a house collateral line of credit really works?

Let’s say you have a property appreciated at the $five hundred,000, as well as your existing financial is for $300,000. The fresh security in your home is the difference in both of these numbers. In this instance, that is $two hundred,000 ($500,000 – $three hundred,000 = $2 hundred,000).

When you apply for a great HELOC, borrowing unions particularly iQ take into account the combined mortgage-to-worthy of ratio . So it proportion includes one another your existing mortgage together with prospective HELOC count. Like, if the a credit commitment enables you to borrow doing ninety% of residence’s worthy of , the of current financing together with HELOC don’t meet or exceed it restrict.

In our example, 90% of house’s worth try $450,000 (90% out-of $500,000). Because you have a great $300,000 mortgage, the most most amount you could potentially borrow compliment of a great HELOC manage be the variation, which is $150,000 ($450,000 – $3 hundred,000).

So what can you utilize a great HELOC having?

- Since rate of interest is frequently below very credit cards otherwise fund, it is good for debt consolidating.

- It can be used to cover remodeling methods to improve the value of your property.

- A HELOC can be used for big-solution activities, such a vacation domestic or unexpected expenditures.

Which have an effective HELOC, you always keeps a top borrowing limit than just you would having a credit card, with regards to the amount of home security offered.

Rates to have a good HELOC can also be fixed or varying. An iQ HELOC, eg, features a varying rate, while you is also protect servings having a fixed rate. You only pay notice on level of the line of credit you employ.

What are the downsides so you can HELOCs?

HELOCs can be establish certain demands. Of numerous HELOCs has actually relevant charges; particular need at least credit line count. You also need to spend promptly to guard their borrowing score, therefore exposure dropping your house if you fail to create your repayments. Your own party in the iQ can help you assess your situation so you’re able to help you prevent such challenges and make use of the HELOC to arrive your financial requirements.

How do you calculate their residence’s equity?

However, there are many more products you will want to believe when figuring their family guarantee. Such as for example, how much is the a good mortgage? If you have had your property for a time, you’ve got paid your own home loan that will owe quicker toward your property compared to the brand-new loan, so that you have more house guarantee readily available.

Your credit rating is another factor. Qualifying to possess an effective HELOC feels as though qualifying for any other sorts of away from mortgage, therefore, the best your credit rating, the much more likely youre to help you qualify plus the best the fresh terms of this new HELOC.

Be sure to take on the present day market price of one’s home-not the worth of your house after you purchased. Houses thinking usually improve yearly, which means your residence is more than likely really worth more than after you ordered they.

Figuring the outstanding financial up against the newest value of their home is known as loan-to-really worth (LTV) proportion . Should your LTV proportion is large, then you’re considered large-chance.

Should access your own house’s well worth? iQ can help you with a good HELOC.

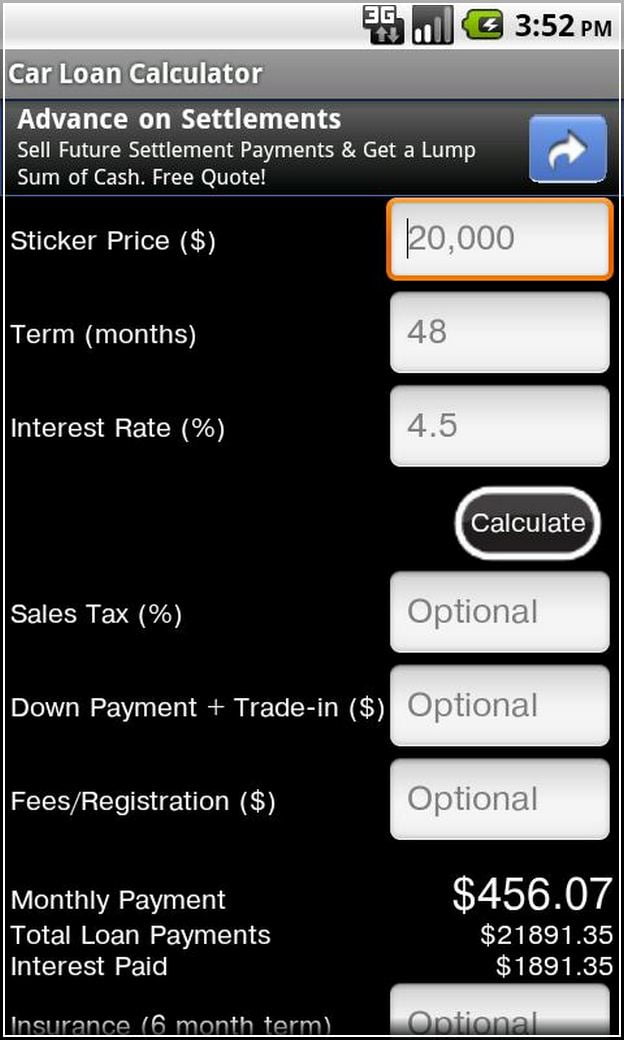

Wanting a beneficial HELOC, thinking exacltly what the HELOC commission would be, or exactly what can you perform with this specific particular guarantee?

The home equity mortgage benefits in the iQ can help you. iQ’s mission is to try to mate with professionals to assist them to achieve the economic desires, in addition to finding the best devices to help make the most of family guarantee.

Should you want to learn more about home security and you can house financing, a starting point was our very own guide to homebuying and you will resource, Mortgages 101.