What does a 1% difference in mortgage speed count?

When you begin looking to buy property, you are able to listen to all about home loan costs as well as how far they sucks that they’re increasing, exactly how higher its if they’re heading down, if you don’t why reduced mortgage costs aren’t usually a good situation.

Exactly how do you can it percentage? And how can it extremely apply to simply how much you pay? On purposes of this post, I shall evaluate just how only a 1% difference between the financial rate normally positively affect exactly how much you spend.

Since you will notice about desk lower than, a 1% difference in a beneficial $two hundred,000 house or apartment with a good $160,000 financial grows their monthly payment from the almost $100. Whilst difference between payment per month may well not appear you to definitely high, this new step one% higher level form you can easily spend up to $29,000 more within the appeal along the 30-12 months title. Ouch!

How home loan rates work

A mortgage is a kind of loan familiar with buy an effective family or other a property. The rate with the home financing ‘s the percentage of new full amount borrowed you will have to expend simultaneously with the prominent, otherwise totally new, amount payday loan Dove Valley borrowed.

The rate for the a home loan is often indicated since the a keen apr, otherwise Annual percentage rate. Thus you will need to pay-off the mortgage and additionally desire fees over the course of the life span of the loan. The speed for the a home loan is repaired otherwise adjustable, based the lender’s small print.

If you have a predetermined-price financial, in that case your rate of interest does not change-over living away from the loan. But when you possess a changeable-rate mortgage, this may be normally change in line with the Primary rates, such as.

Just how a-1% difference between financial rates impacts everything you spend

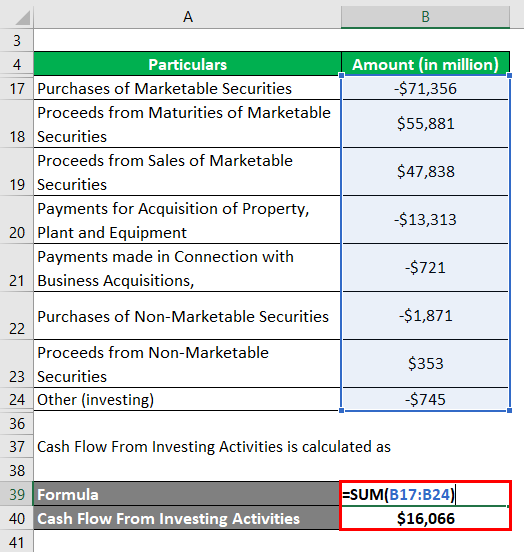

Inside analogy, can you imagine you are looking to take out a mortgage getting $two hundred,000. Should you get a thirty-season home loan and also you create an effective 20% advance payment out of $forty,000, you should have good $160,000 financial.

For those who merely establish 10%, you have a good $180,000 financial. Next table helps guide you far you can shell out – one another per month as well as the life span of financing – in the for every single condition.

*Fee wide variety found do not is personal home loan insurance rates (PMI), that is certainly expected towards the financing with down payments out of faster than just 20%. The genuine payment could be high.

So it computation in addition to doesn’t come with property taxation, which could improve the prices considerably if you live into the a beneficial high-income tax city.

Within example, a-1% mortgage rates change results in a monthly payment that is near to $100 higher. Nevertheless the real change is when far more you are able to pay in the focus over three decades…over $33,000! And just consider, if you lived-in the fresh 1980s in the event the highest financial rates was 18%, you would be paying thousands 30 days only when you look at the attract!

What exactly is currently taking place so you can home loan costs?

COVID-19 pressed mortgage interest levels down seriously to checklist lows, dipping to a jaw-losing 2.67% inside the . Sadly, 30-year repaired mortgage rates provides because the ballooned to help you on average 8.48% by .

But do not become too bummed away. Believe you to into the latest eighties, a consistent home loan rate was between ten% and 18%, and you will a great 8.x% speed does not see as well bad, relatively. Obviously, the expense of home enjoys grown ever since then, however, home loan costs are however considerably less than they could become.

The way to get the lowest financial price

Unfortunately, you don’t need to a lot of personal command over the brand new average rates offered by a date. Nevertheless do have a large amount of control of the latest costs you’ll be given according to an average.