Exactly how slices you certainly will perception varying and you can fixed interest rates

The latest Given began the easing stage to your the best cut while the 2020. This is how it might feeling multifamily a home traders.

Key takeaways

- The newest Federal Open market Committee (FOMC) paid down their benchmark by fifty basis facts-the initial rate cut-in over number of years-bringing the address federal funds diversity so you can cuatro.75%5.25%.

- New Given expressed it can always disappear rates, but the timing and you can rate off price reduces is dependent upon multiple things, along with inflation or any other future monetary data.

- Multifamily buyers have many possibilities contained in this ecosystem, for example refinancing and profile expansion choices.

Research because of the point

Immediately following a few price nature hikes and over annually out of rate of interest uncertainty, the newest Government Reserve dropped pricing for the first time due to the fact so you’re able to start an reducing stage.

Already, this new Fed is wanting their utmost so you’re able to equilibrium relatively complete work having a two% rising prices address, told you Al Brooks, Head from Commercial A property, JPMorgan Pursue. That isn’t a facile task.

Dealers, plus those in industrial a house, today deal with questions relating to the timing and you will pace of great interest rate slices. The brand new responses could have big ramifications getting rising cost of living additionally the monetary way in the future.

Brand new Fed’s latest quarterly monetary forecasts mean a further 0.50% Given simplicity towards the end of 2024, and one step one.00% complete protection towards the end off 2025, said Mike Kraft, Commercial A home Treasurer getting Commercial Banking in the JPMorgan Pursue. Immediately after the fresh FOMC announcement, the new Fed loans futures field ran sometime after that, enjoying from the an 80% danger of a great 0.75% .

“You will need to recall the easing years needs put over go out, and one upcoming cuts might possibly be predicated on arriving studies,” said Ginger Chambless, Head out-of Search having Industrial Banking at JPMorgan Pursue. In the event that upside rising cost of living risks still ebb even as we expect, the interest rate away from Fed cuts should be relatively brisk.

The possibility of a depression

The latest Fed’s purpose stays controlling a job having inflation to produce an excellent mellow landing. But a recession is still possible. Credit crunch estimates keeps ticked right up a small recently but they are seemingly low. Our company is primarily concerned about next air conditioning in work bless said. So far, it seems like normalization, perhaps not destruction.

Whenever you are buyers try hopeful for rates of interest to drop, you have got to keep in mind that reasonable incisions seem sensible as the benefit cools and you may rising prices reduces, Brooks told you. When the dealers is dreaming about big rate of interest incisions, they had want to see a severe payday loan Denver recession.

It’s enticing to think that in case brand new Fed were to all the way down its target rates because of the step 1.50%dos.00% across the next season roughly, we’d come across likewise down Treasury returns and you can home loan costs, Kraft told you.

But fixed rates of interest strive to build in most coming Given activity, the fresh much time-title financial outlook and you will inflationary standards-besides what are the results in the 2nd FOMC meeting.

The fresh new Fed’s tips usually do not myself connect with fixed costs, which can be related to much time-name inflationary traditional. Monetary studies, like consumer expenses and you can work reports, may move such medium- to help you long-identity fixed cost than just interest decrease.

Exactly what down interest rates you are going to mean to possess multifamily investors

Which have rates ascending smaller and higher than in current recollections, earnings coverages on of many sales provides obtained skinnier, Brooks told you. Because of this, industrial a house loan providers have obtained to take out more reserves up against the portfolios.

As rates fall off, cashflow exposure increases, reducing loan loss supplies to possess banking institutions,” the guy said. “Down reserves are able to be put to the market and you may assists even more package move.

Enhanced liquidity minimizing borrowing will cost you usually end up in rising prices, that may alter apartment strengthening values. It is really not buck-for-dollars, however, since the rates of interest decrease, limit cost always slip somewhat with them, Brooks told you.

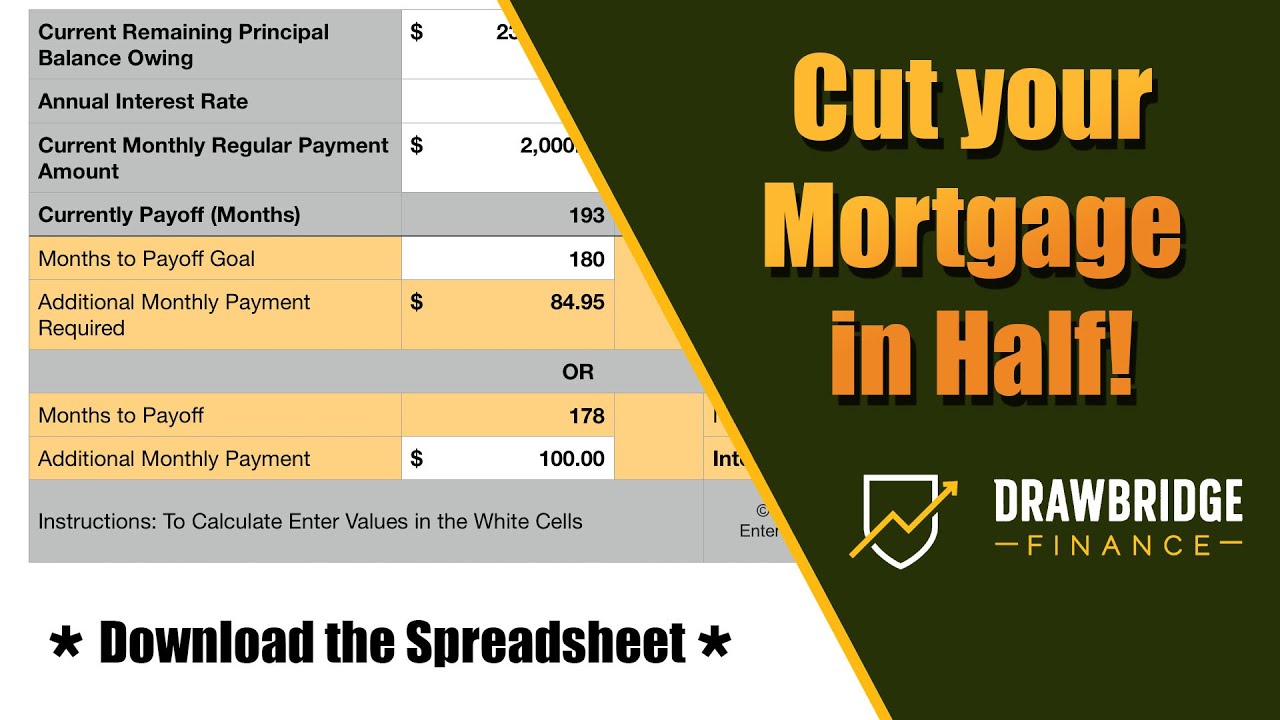

- Refinancing qualities: Losing rates shall be particularly beneficial for investors that have fund near the conclusion their label. From the refinancing, dealers normally down their monthly obligations and possibly cut thousands of dollars when you look at the interest. Assets refinancing may also help increase income and you can free up funding for home improvements otherwise the brand new building purchases.

- Growing its local rental profile: Valuations provides calmed off a great deal, Brooks said. Which is particularly true for the larger locations particularly La, Nyc and San francisco, where cost of living may be highest and there is an obviously highest pool regarding renters. Other than expanding so you’re able to the ily investors can add on this new investment classes on the portfolios, such as mixed-play with, merchandising and you will industrial characteristics.

New extremely reduced cost viewed lately is seen as the an anomaly stemming about 2008 High Financial crisis and you may COVID, Kraft said. Near-no rates try impractical to return. It could take traders and people a while adjust fully to brand new landscaping.