Normally lose that which you whether or not home is almost repaid?

Suppose there’s an older partners exactly who bought property twenty seven many years back. He’s got vigilantly made new money on their financial, and currently the collateral was ninety five%. Out of the blue, the latest partner manages to lose his business, and they can’t make mortgage payments. And so the foreclosures processes starts.

Have always been I true that, if your property foreclosure processes is brought to achievement and partners seems to lose their home, they’re going to eradicate all of that ninety five% security it built up? Quite simply, they will be managed the same as a young pair who currently has actually 4% guarantee in their home?

In the event that’s correct, next generally this means that good homeowner’s risk expands as their guarantee expands. And this seems types of perverse.

Can be dump that which you even if house is nearly paid down?

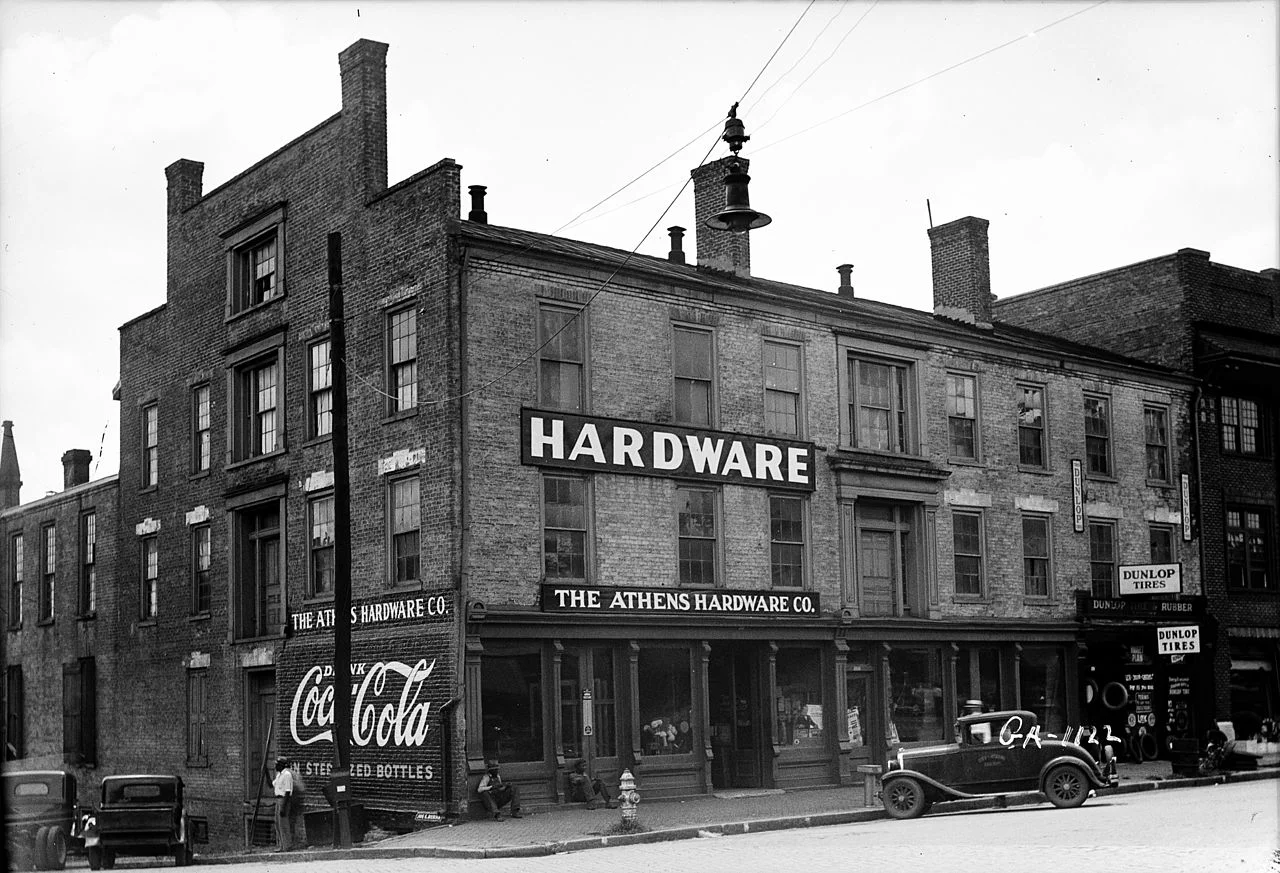

_1936_Historic_American_Buildings_Survey.jpg)

- mortgage

- foreclosure

7 Responses seven

This particular article brings good breakdown of this new ins and outs from it: What takes place in order to Collateral throughout the a foreclosures.

The latest quick adaptation is that you have earned the continues from a house available in property foreclosure minus any the balance with the the loan, charges, and every other can cost you the lending company incurs in process. Create remember that foreclosures households tend to promote at the a severe dismiss, so the potential for dropping an enormous chunk regarding collateral are high in this condition.

8% these types of property tend to choose for less than belongings in which they financial was permitted fifty%+. Of many states do not require the home be produced available getting public auction and often private revenue occurs prior to they go so you can the business. My wife performed term benefit foreclosures transformation and told me regarding such sporadically.

In case the couple might have been making its payments faithfully for twenty seven decades, first off I think the financial institution might be ready to discuss. A property foreclosure is not the ideal choice for anybody.

And, understand that youre talking about 8% of one’s brand spanking new loan amount. Let’s say the house ran for $150,000 (nominal) in the event that few bought it twenty seven years back. That’d more likely with the higher side, and additionally the current market price of the home try unimportant because of it formula. It would hop out these with a $12,000 loans stream at the moment. Even a fairly highest-appeal ( not credit card) loan for the number was most definitely tolerable regarding notice will cost you actually to your a finite money; an excellent 10% interest would happen a fees away from $100/few days just before tax effects. A fees propose to pay a loan of into the 5 years brings the initial huge add up to the regional out-of $300/day.

As the has been mentioned, the financial institution are only able to get what’s owed on it, but of course in case your just additional security the happy couple can be provide are locked up inside your home, selling the house is just about to getting necessary to allow availableness compared to that collateral. In some jurisdictions (I am not sure concerning the You, however, Sweden enjoys eg provisions), debt collection is actually especially called out to be manufactured from inside the given that non-intrusive an easy method to. Sure, the bank normally push a foreclosures for the house, or that matter various other house which is guarantee for that loan, however if there are more assets which you can use in order to protection your debt and will also be quicker intrusive to your couple’s life, people is removed first. And it’s really rare this 1 has no assets except that new house, like in the years fifty+.

In case your bank nevertheless need payment in full to stop property foreclosure, specifically which have instance https://paydayloancolorado.net/ouray/ a somewhat bit a fantastic, it may not end up being unrealistic to inquire about available for your own financing regarding family members or family unit members. Make use of it to repay the mortgage to your lender (otherwise care for costs), next pay it off to whoever loaned all of them the cash as quickly that you can.