For those who be eligible for each other a traditional and FHA loan, which should you choose?

FHA fund versus. old-fashioned money

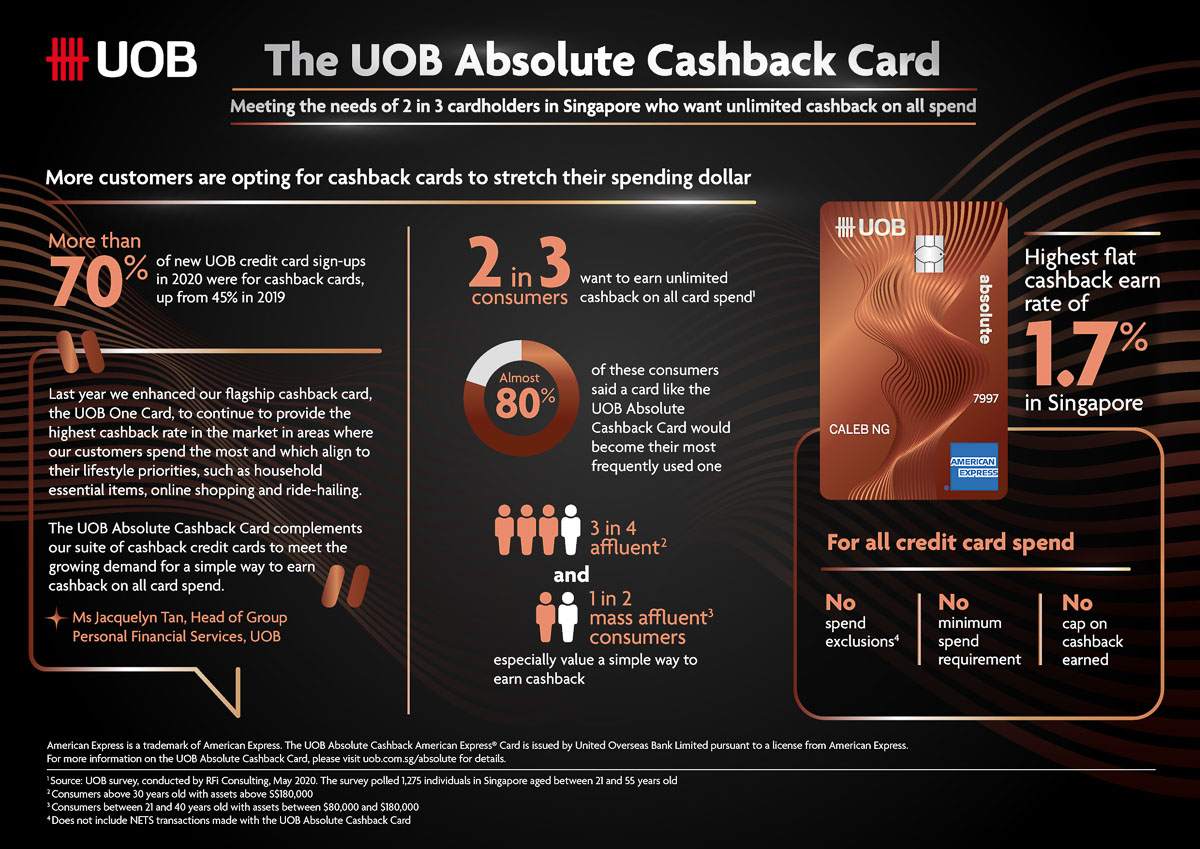

FHA loans have all the way down rates of interest than just old-fashioned loans, nonetheless they also provide high upfront costs. How do FHA financing compare to 31-season repaired mortgage loans? Comprehend the dining table less than having a typical example of the expense associated that have an enthusiastic FHA mortgage in place of a thirty-seasons fixed financing. Keep in mind that interest levels is actually determined by the market and borrower’s creditworthiness.

For many who qualify for each other, I would probably pick the standard mortgage. FHA’s large mortgage insurance policies (MIP) comes with step 1.75 % of loan amount upfront, also monthly installments. FHA loans are a good choice for individuals having sub-700 credit ratings rather than lots of money getting a downpayment, although disadvantage is the MIP, which FHA fees because of the greater risk grounds. Whenever you rating a conventional mortgage, viewers the non-public home loan insurance rates (PMI) costs shorter which is simpler to lose as soon as your loan-to-worth (LTV) ratio strikes 80 percent. To possess consumers that simply don’t be eligible for a normal mortgage, the fresh new wise disperse is to try to use the FHA financing, up coming refi for the a conventional mortgage as soon as your credit enhances and the latest LTV proportion appears top.

FHA loans tend to have most useful pricing however, a hefty mortgage premium upfront. Traditional funds features somewhat high cost, but if you set out 20%, there isn’t any home loan insurance coverage. For folks who financing more 80 %, the mortgage insurance policy is cheaper than having an enthusiastic FHA loan. With the knowledge that pricing will most likely flow down notably regarding 2nd eighteen months, I would personally capture a normal financing which have down initial charge. For those who amortize the price of the excess financial insurance policies and intend on refinancing when cost was straight down, the typical price will end up becoming minimal.

FHA mortgage criteria

- FHA loan constraints: $498,257 for an individual-family home; large inside costlier areas as well as multifamily residential property

- Minimum credit rating: 580 with a great step 3.5% down-payment, or five hundred with an excellent ten% down payment

- Restriction loans-to-income (DTI) ratio: To fifty%

- Mortgage insurance fees (MIP): step 1.75% of your financing dominating upfront; monthly installments thereafter considering number you borrow, deposit and you may loan label and type

- Financial and you will work history: Evidence of uniform a job and you can income

FHA mortgage insurance

FHA loans require consumers whom lay out lower than 20 percent to pay financial insurance premiums (MIP). Mortgage insurance premiums include a meaningful add up to their payment per month, very remain these will set you back in mind if you find yourself budgeting to possess good household.

There are 2 type of premium: brand new upfront mortgage top (step one.75 % of feet amount borrowed) and you can a yearly financial advanced (0.fifteen visit web-site % so you can 0.75 per cent, according to loan name, loan amount and mortgage-to-well worth (LTV) ratio). The newest yearly advanced try owed on loan’s lifetime in case the deposit was lower than 10 %; for those who set-out at the very least ten percent, but not, the premium is easy to remove shortly after eleven decades.

FHA financing restrictions

Annually, new FHA status its credit limits and/or restriction number the newest department often guarantee getting certain urban area and property variety of. These types of restrictions are influenced by financial business-brands Fannie mae and you will Freddie Mac’s compliant mortgage limits. To have 2024, the newest national roof was $498,257 to have a single-home, or more so you can $1,149,825 inside the highest-rates parts.

If you get an FHA financing?

- Your credit score is lower than 700 (but above 580)

- You’ve got limited deposit coupons (but sufficient to shell out step three.5 %, along with closing costs)

- You don’t head the newest tradeoff out of high financial insurance fees for loose underwriting standards