Build loan for brand new domestic replacement existing mortgaged home?

Can you imagine I purchase a home which have an ordinary thirty-seasons home loan, about to redesign our home more sluggish and you may live truth be told there an extended big date (10 years at the very least). 5 years to your financial, but not, I choose I wish to generate another household, however, I wish to remain at a comparable address. Put another way, I want to have the dated house dissolved, and build a special household toward today-blank lot (whenever i live in a rental), after that disperse into to your new home and real time indeed there indefinitely.

The new household could well be bigger and better as compared to old, so after it is complete, the actual home as a whole (house and additionally advancements) might be value even more than the fresh amount borrowed.

Is there that loan product that covers this procedure? Must i sign up for a property financing to invest in the latest building, after which roll they on a normal financial, the way somebody manage who will be building property to the raw undeveloped tons? What happens back at my old mortgage while i do that?

We think that the fresh new lienholder might not want us to damage the old family just like the that reduces the worth of the home (no less than temporarily) into the worth of the brand new intense land, exactly what most other choice is there? Exactly what do some one would who wish to get a vintage home towards the location, but want from the start to-tear it down and build another household? Can it simply be finished with a huge cash outlay upfront?

- mortgage

- fund

- real-estate

- loans

dos Answers dos

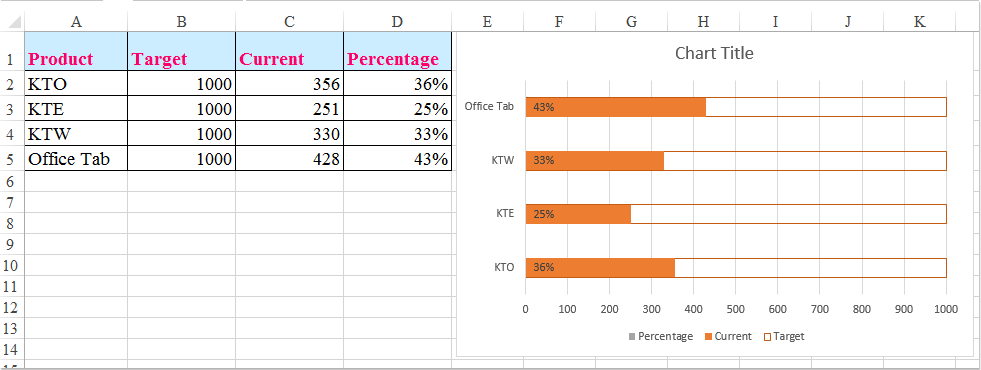

- Package worthy of: $fifty

- Latest house well worth: $2 hundred

- Current overall market value: $250

- Most recent amount borrowed: $150

- Current security: $100

Very within this analogy, you will damage $250 inside really worth, repay the existing $150 financing and have now to blow $300 into generate the fresh new household hence analogy does not have enough equity to pay for they. You typically cannot get that loan for more compared to (anticipated) value of.

Basically, you need to get a houses loan to fund paying off the existing financing also anything you should spend to invest toward new home without any type of you intend so you can lead from savings. The financing will need to be for less than the fresh new the newest complete market price. The only method this may exercise this way is when you promote tall dollars so you can closure, or you owe less than the fresh new lot really worth towards most recent assets.

Notice, this particular is in perception a beneficial simplification. You can save money strengthening a home than simply it is value whenever you might be done with it, etc., but this is basically the basic means it could functions – or perhaps not work in many cases.

When your worth of the fresh house is above the worth of the outdated home, such as if you’re speaking of substitution a little, run-down dated family really worth $50,000 with a giant this new residence value $ten,000,000, then your property value the existing home that’s shed you will just wander off from the rounding https://paydayloanalabama.com/grove-hill/ problems for everyone fundamental objectives.

Build mortgage for brand new family replacement present mortgaged domestic?

But if not, I don’t observe you would do that in place of getting bucks towards the desk basically comparable to everything nevertheless owe to your the existing family.

Allegedly the new residence is value more the old, therefore, the property value the house or property if you’re complete might possibly be more than it was just before. But commonly the value of the house or property be much more versus old financial while the the fresh new mortgage? Until the old financial is nearly repaid, or you give a number of cash, the clear answer is close to yes “no”.

Observe that in the lienholder’s attitude, you aren’t “temporarily” reducing the property value the house. You are forever cutting they. The financial institution that renders the fresh new mortgage will receive a lien on the new home. I am not sure just what legislation states about any of it, you will have to either, (a) purposely damage assets that a person otherwise keeps a good lien with the whenever you are giving them no payment, otherwise (b) bring a few finance companies a beneficial lien for a passing fancy possessions. I won’t believe both solution is judge.

Normally when people split off a building to place on good new strengthening, it’s because the value of the outdated strengthening is so lowest on getting minimal compared to value of the strengthening. Often the old building are work on-off and having it for the pretty good contour perform cost more than simply tearing they off and setting up a special strengthening, or perhaps there is some work with — genuine or understood — to the the latest building that makes which worth it.