Are you willing to Rating an enthusiastic FHA Mortgage to own a mobile House within the 2022?

This new Government Construction Administration (FHA) brings house loans to own standard, prefabricated, and you will cellular land in order to accredited people and you will eligible attributes. The best technique for funding a great prefabricated residence is by the a routine FHA mortgage. Usually, both the homes while the prefabricated household is acquired along with her. The goal citizen(s) need to meet up with the very first recognition conditions.

The FHA financial program is still among the many ideal ways to financing property pick. This new down payment merely 3.5 per cent and may even getting “donated” of the a qualifying donor (i.e. mothers, sisters, and you will around specific conditions, a good friend). Owner can get shelter particular otherwise the customer’s closure can cost you. Find out more in the FHA family-finance

FHA manufactured, standard and you may mobile household-financing guidelines

As a result of the FHA’s guarantee of FHA prefabricated mortgage brokers, specific conditions should be found. One of them is the pursuing the, yet not simply for:

- The new residence must have become centered just after June fifteen, 1976.

- 400 sq ft ‘s the minimal proportions which can be financed.

- For every goods should have this new red HUD name.

- Our home need to be permanently connected with a charity who has got started approved by the FHA.

- The latest prefabricated home’s location have to be allowed.

- Our house have to conform to the brand new Model Are produced House Set up Criteria.

- The fresh residence ought to be the owner’s principal residence.

FHA Identity I loan

Brand new Federal Construction Administration’s https://paydayloansconnecticut.com/stafford-springs/ identity step one lending program promotes the acquisition otherwise refinancing away from prefabricated belongings. A title We financing may be used to buy or refinance a prefabricated domestic, establish property on which to build one, otherwise a mix of both. The new borrower’s dominant home ought to be the house.

Borrowers are not needed to very own otherwise individual the house into hence its prefabricated home is based in purchase in order to be eligible for Term We insured money. Rather, borrowers may book much, particularly a web page parcel inside the a created house area otherwise cellular household playground.

If homes/lot is actually leased, HUD necessitates the lessor to provide a great around three-season first lease term into are created resident. On top of that, brand new lease need certainly to stipulate that when the fresh new book is to be ended, the fresh homeowner need to be provided at least 180 days’ written notice. Such book stipulations are designed to cover residents if for example the lessors offer this new house otherwise close the brand new playground.

two decades having a mobile financial otherwise a manufactured family and you will package loan in a single part fifteen years to own an excellent prefabricated domestic residential property mortgage A twenty-five-season loan having a multi-area prefabricated house and land Provider: Institution out-of Construction and you will Financial support

This new USDA and are created construction

The united states Company out of Agriculture (USDA) will enable the entry to a created home loan to finance the purchase off a qualified the latest device, distribution and you may setup costs, plus the purchase of an eligible site (or even already owned by the fresh new applicant).

Prospective home owners have to fulfill normal qualification requirements, which includes money, a position duration, borrowing, month-to-month earnings, and month-to-month debt obligations. Read more on the USDA certification

In case the unit and you will venue is secured by a genuine property home loan or deed out of faith, a loan to cover the next is guaranteed.

Work with an internet site that complies with county and you will state standards. Acquisition of another type of eligible product, transportation and you will settings costs, together with purchase of a new qualified web site should your candidate cannot already own you to. Are created products need to be less than a year old, unoccupied, and completely contains inside the webpages.

The purchase arrangement must be performed in one year of your are available time of product, as the found on the plat. An excellent product that’s entitled to the newest SFHGLP ensure have to satisfy the next requirements:

To qualify, the latest product should have a minimum space on the floor out-of 400 sqft. The prefabricated home need conform to Federal Are designed Domestic Build and you may Safety Criteria (FMHCSS).

The device must be permanently installed on a foundation one complies having most recent FHA laws during certification. HUD-4930.3G, “Are built Housing Permanent Base Publication,” has become available online from the

The foundation build is accepted in order to meet the requirements of HUD Manual 4930.step 3, “Long lasting Foundations Book to have Manufactured Houses (PFGMH).”

The origin qualification should be provided of the a licensed elite group professional otherwise registered architect who is signed up otherwise inserted in the condition where in fact the are available home is based and will approve you to definitely this new are built home complies with current PFGMH criteria.

New certification should be website-certain and include the brand new signature, seal, and/otherwise state licenses/qualification level of the brand new engineers otherwise joined architects. Find out more

Issues and you will Responses from Are produced Lenders

Q. Should i found a cellular financial which have dreadful borrowing from the bank? An effective. The fresh new Federal Houses Management (FHA) have a tendency to funds a mobile household in the event your design complies that have FHA needs (discover more than) additionally the applicant(s) fulfills FHA’s practical borrowing and you can income conditions. The fresh FHA will accept candidates that have fico scores only 500 (up to 579), but will require a great ten% downpayment. The brand new restricted downpayment towards the a property that have a credit rating out-of 580 otherwise more than is actually step three.5 per cent.

Q. How do i make an application for an enthusiastic FHA-covered cellular financial? A. Simply fill out an application so you can a keen FHA-recognized financial.

Q. The length of time will it get having a mobile financial so you can get approved? A. Acquiring pre-recognition otherwise mortgage recognition usually takes only one or 2 days, providing the candidate gets the needed papers (i.elizabeth. spend stubs, W-2 versions, lender statements, an such like.).

Q. Exactly how much downpayment needs for the a mobile domestic? A beneficial. Because before conveyed, a beneficial 3.5 percent downpayment is needed getting individuals having a card get better than 580.

Q. Would it be hard to find financial support for a cellular house? Good. Mortgage approval is pretty easy in comparison with other types of mortgages.

Q. Was prefabricated homes entitled to FHA money? Good. Probably. Many organizations are aware of the FHA’s strengthening requirements making the work to stick to them.

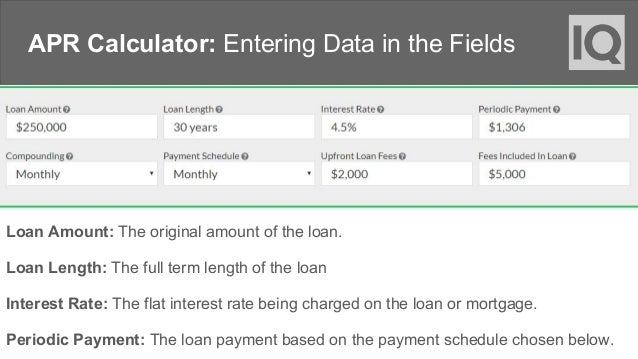

The newest calculators and you may information regarding this site are supplied for your requirements once the a personal-help equipment getting instructional motives only. We can not and do not make sure the appropriateness or correctness of your own guidance in your particular situation. We highly advise you to rating private the recommendations from skilled gurus.