Spend From the Cell phone Casinos Play at the Better Cellular Charging Sites

Content

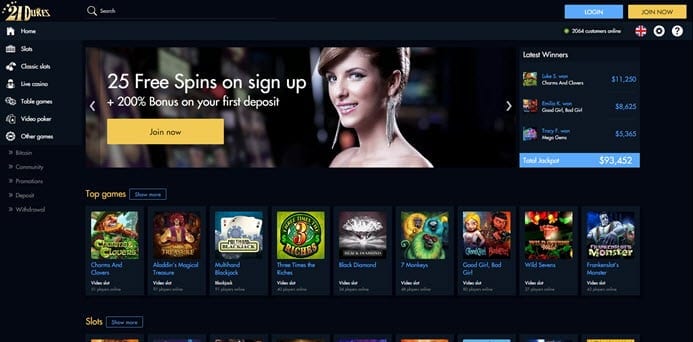

Extremely mobile gambling enterprises in the 2024 allow you to allege special incentives (for both the brand new and typical professionals) if you are using the fresh shell out because of the cellular phone bill alternative. It’s always a good suggestion to read through the newest promo T&Cs thoroughly basic whether or not, as there are specific offers where only specific fee actions can be be used to claim. E-purses including Skrill and you may Neteller usually are omitted from incentives. Utilizing the pay from the mobile phone bill solution during the casinos on the internet are very easy. Fundamentally, all of that goes is you’lso are recharged for your internet casino put during your cellular phone costs.

This will make him or her popular certainly traffic and you can college students of its hometowns. As well, he’s popular with moms and dads who wish to has a method to remain regarding their university many years wjpartners.com.au use a link people and have particular command over the expenses. While you are late to the a mobile phone commission, allow it to be a top priority to find most recent on the membership before their company directs they to selections otherwise fees it off. With many credit reporting models, late cellular money won’t have an effect on your credit score until the newest account goes to collections or perhaps the company fees off of the debt. Yes, i sanctuary’t seen any Pay From the Cellular gambling enterprise that does not undertake notes, coupon codes and also specific cryptocurrencies while the fee procedures.

And then we know the anger of waiting around for what appears to be an enthusiastic awkwardly enough time length of time through to the deal is approved and you can eliminate the credit. Using your cellular phone to spend waiting for you or build payments on the web is relatively easy, but there are some actions you need to to install faucet-to-pay on your cell phone the very first time. To get started with Apple Shell out, discover the fresh Wallet application that comes pre-mounted on your own iphone and you will are the notes that you want to make use of.

Make sure to read the casino’s lowest/ limitation put limitations ahead (more info lower than). For every shell out-by-cell phone casino goes through thorough comment by the at least two of our very own team’s writers, making certain that the new gambling enterprises we advice is genuine and up in order to go out. Anyplace to the high street which will take contactless cards and now have has a fruit Shell out, Yahoo Spend or Samsung Shell out symbolization works, and Marks and you can Spencer, Lidl, Pizza Show and you may Boots. SumUp is actually PCI-DSS certified, and its own card viewer is official from the PCI, EMV, Mastercard and you will Charge. You can arrive at customer care from the cellular telephone twenty four/7, or by cellular telephone, current email address, live speak otherwise Twitter. For individuals who’d like to troubleshoot an issue yourself, the firm brings multiple resources to help you, and courses and lessons, a good searchable knowledgebase, a person forum, and you can a site.

Inside an equal-to-fellow mobile percentage, you are and make an age-import through your bank to, say, shell out a friend straight back for dinner or someone for the Craigslist to possess a piece of chairs. Inside a cellular commission from the a brick-and-mortar team, you’lso are using an app on your mobile device—unlike dollars otherwise a credit—to pay for specific goods otherwise characteristics during the checkout restrict. In this instance, the company would want a particular type of point-of-selling unit (and this we obtain to your less than) so you can process your order.

Cellular mastercard processing is now much more prevalent, that have cellular point of selling (mPOS) tech currently on the rise. For those who’lso are curious about how to take on cellular credit card money to own small company, we’ve got you secure. Discover everything you need to know to just accept credit costs on the a telephone, here. From your own SumUp account web page, you can add team for your requirements. For each staff features her sign on credentials, and can accept mastercard money and see their transformation histories.

- For each worker provides their particular login credentials, and certainly will deal with mastercard costs and see the conversion process records.

- Using, bitcoin purchases, and you may tax submitting are all practical and you can rewarding has to have within the a cellular percentage app.

- Using Payanywhere’s cellular card reader to the application enables you to matter digital receipts, perform catalog, group and you may customers and you may lets you song sales.

- This is how a different sequence of quantity, called a good token, is established for this you to definitely-day deal.

- Samsung Pay delivers strong mobile commission characteristics one to gamble sweet which have the business’s of several gadgets and you can points.

Yet not, if you’d like extra provides, you may want to choose one of your paid arrangements. That it 100 percent free solution saves their percentage methods to immediately shell out their T-Mobile statement by the deducting costs from your own charge card otherwise examining membership. Small enterprises will always looking for the most economical method of getting the task complete.

A number of the best gambling apps in the united states often perhaps not fees transaction fees to make deposits and you may withdrawals. Using this are told you, see the fine print on the bookmakers with your favorite put means. Along with with a cap to the limit deposits, your claimed’t be able to cash out by using the shell out by cellular telephone method. You need to discover a new financial substitute for withdraw their payouts. Once you create a mobile deposit, you could potentially love to enjoy one online game from the casino’s library.

How can you deal with productivity in the case of cellular money?

The most significant mobile fee experience Apple Pay, rendering it easy to possess ios pages to put instantly. You can add as much as a couple of years out of commission record out of the service team of your preference to the credit history, possibly enhancing your credit rating. Cell phone business will also look at the credit if you need to invest in a new cellular phone. Of many cellular phone providers now need you to get or rent a new mobile phone. In either case, you will likely end up with a payment policy for your new mobile phone with short monthly obligations included with their month-to-month service payment. Based on items that include cost and you will simpleness, we recommend cellular credit clients out of Square, Clover and you can PayPal.

Within the last couple of years, Jenn provides resulted in Forbes Coach and you will a variety of fintech companies. She’s got served as the an excellent UX representative, moderated discussions for the unlock banking and you will been an invitees for the an excellent quantity of private fund podcasts. Although not, you can find about three big mobile wallets designed for particular type of products. To your credit chose, be sure your identity through Touching ID, Face ID or your passcode.

When is also contactless cell phone repayments be useful?

In just their valid SA ID guide, Proof of address zero more than 90 days, SA phone number, email and you can a deposit amount, we’ll approve your application quick. Rating 1 year out of a lot more protection to suit your smartphone that have prolonged warranty service. Pay from the cellular telephone costs, also called shell out by mobile, is still trying to enter sportsbooks.

Perfect for Shopping online

Following PayPal’s guidelines to own suppliers reduces the likelihood of getting the money kept inside the a reserve account. Along with make certain that the items or characteristics your organization will bring are within this PayPal’s appropriate play with coverage; or even, their finance could be suspended otherwise your bank account signed with no warning. To promote its QR code costs, PayPal try charging a lesser price from 2.2% of any QR password transaction until March 30, 2021.