Just what New Down Interest rates Imply to you personally

If you’ve got a mortgage, it is almost definitely one of most significant financial burdens. And even though positives predict home loan interest levels to increase within the 2021, they are nevertheless seemingly reasonable compared to the in which these were in advance of new pandemic. Meaning it may nevertheless be a good time to you to re-finance and you may cut.

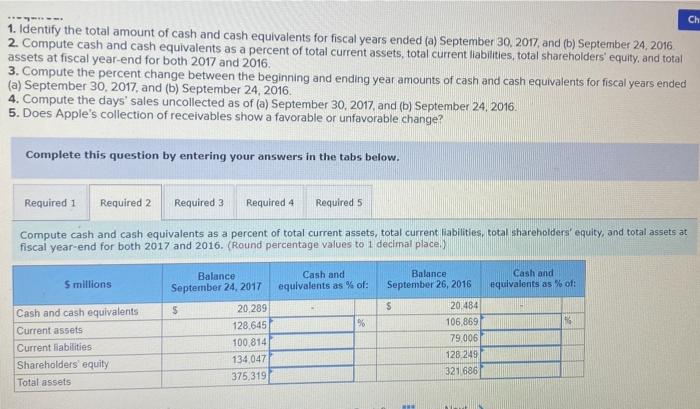

Today, the average rate of interest to have a 30-season fixed-rates refinance try 3.32%, if you’re a fifteen-12 months repaired-speed re-finance comes with the average rate of interest out of 2.68%. Even if our company is not any longer seeing the newest stone-bottom rates on middle of pandemic, home owners looking to refinance can still select significant deals.

Here’s as to why today will be a fantastic time for of a lot to refinance and how to know if an effective refinance is useful for you.

That have rates of interest steadily rising on stone-bottom they hit when you look at the start of COVID-19 pandemic, the latest chance of having the very coupons off latest refinance pricing was easily closing. Regardless of if mortgage prices are continuously when you look at the flux from times in order to few days and you can unanticipated falls or increases both happens, the overall development things to ascending rates on the close coming. Not surprisingly, but not, interest levels continue to be lower than pre-pandemic profile, therefore those individuals seeking to money can still be capable of getting considerably when they act soon.

What’s Refinancing?

Mortgage refinancing happens when you’re taking out a different sort of mortgage to change your existing that. Possible keep current house, but you will possess a different mortgage that have probably various other terminology.

- Taking a lowered interest

- Swinging off an adjustable-rate to help you a fixed speed

- Reducing PMI, or personal home loan insurance policies

- Reducing the definition of of one’s home loan to shell out it of at some point

- Improving the identity of the financial to lessen your own monthly payment

How come Refinancing Really works?

After you re-finance the financial, you will get an alternate mortgage to replace your current mortgage. You will have to experience a number of the exact same tips out of delivering a special house: trying to get financing, underwriting, domestic appraisal, and you can closure. The real difference would be the fact unlike seeking a special family, you’ll keep your most recent house.

Same as after you sign up for a home loan to possess an alternate household, you will need to submit an application and you will meet bank criteria when you look at the components including credit score, debt-to-earnings proportion, and you may work background. When you re-finance, you could had opted with your brand spanking new financial otherwise pick another you to. Additionally, you will need to have enough guarantee of your house – usually no less than 20% – to be eligible for a good re-finance.

Remember that additionally, you will need to pay settlement costs and costs, and is step 3%-6% of one’s loan’s worthy of. This will total up to several thousand dollars, so crunch the fresh new amounts to be sure the currency it can save you into the interest exceeds the newest settlement costs.

What exactly is good Home loan Refinance Rates?

There isn’t any set fundamental having a https://www.paydayloancolorado.net/fraser good refinance rate. Essentially, an effective re-finance rates shall be about step 1% less than your current home loan price getting an effective refinancing and come up with sense, but you will need crunch the new wide variety to really know whether good re-finance is reasonable for your requirements.

The easiest way to do that is always to determine the break-even area. While the settlement costs and you may fees can also be need a substantial matter initial, we want to make sure the money you might be protecting with a diminished interest rate are more than the quantity you will be paying to help you refinance. From the calculating the break-also area, you can observe how much time it is going to take to recoup the latest initial costs for a re-finance.

If you refinance, definitely look around that have several lenders to obtain the finest re-finance rates. And keep maintaining in mind you to definitely even in the event average rates is actually lowest immediately, this costs you can get depends upon individual items such as your credit rating and obligations-to-money proportion.

Professional Tip:

One which just jump on the refinance bandwagon, need a closer look at your earnings balances. If you aren’t totally safer, wait before entering a home mortgage refinance loan travel.

Why you should Re-finance Today

When the a good re-finance falls under debt arrangements, now could be a great time and energy to do it. Listed below are a couple of reasons why you should re-finance today.

Low interest

The current refinance pricing are not any stretched within stone-underside of early days of one’s pandemic, but they can still be much versus pre-pandemic moments. Although not, masters expect rates of interest usually go up, and so the window off opportunity is closing in the future. The earlier your secure a speed, the more likely youre to keep.

Financial data recovery on the horizon

From inside the 2020, new pandemic-created recession and also the resulting economic suspicion brought about certain home owners to help you hold off towards the refinancing. Since refinancing procedure takes months to complete, those concerned with jobs balances may have thought it best to hold back until something was indeed a lot more stable. Economic recovery is on the latest panorama. Individuals who may not have held it’s place in a position in order to re-finance just last year is now able to feel the options.

When to Re-finance Their Home loan

To decide should you re-finance, crunch the newest wide variety on your own. I think it’s a great time to help you refinance if it is proper for your financial situation, claims Michael Chabot, SVP of residential credit in the Draper & Kramer Financial Corp. Come across coupons with a minimum of a 1 / 2 per cent while making yes you feel very confident you can defense your the brand new payment for the life of the borrowed funds.

Including, make certain that you’ve planned to remain in your residence long adequate to recoup the newest refinance prices. It might not getting worth spending thousands of dollars to summarize will cost you to refinance a home you intend to market in the near future.

Eventually, the best time to help you re-finance is the time that works well ideal for the individual financial products and you can requires. If you can rating less interest and you will afford the closing costs, a re-finance could help you save in your payment. However if you are not perception certain regarding your profit otherwise your preparations for your house regarding the upcoming months, it might seem sensible to go to some time to explore a good refi.