Having information, telephone call the brand new Virtual assistant Mortgage brokers Warranty Characteristics from the (888) 244-6711 or see

To have 24/seven the advice, phone call the fresh new National Veteran Drama Hotline at 988, Force 1. It is possible to label the brand new Fl Pros Help Range within one-844-MyFLVet (1-844-693-5838) otherwise dial 211.

Florida Home town Heroes Property System

The latest Fl Home town Heroes Construction Program facilitate Floridians within the over fifty vital procedures buy the earliest domestic and is accessible to Floridians together with police, firefighters, coaches, health care experts, child care personnel, and active armed forces otherwise experts.

The program is given of the Fl Housing and you will Finance Organization (Florida Houses) and contains the greatest and more than inclusive eligibility of all of the Fl Homes down-payment guidance applications. The applying was geared to expanding towards Florida’s existing use a link property software to-arrive critical gurus and people who has served our country. Come across a little more about the applying right here.

This option supporting crucial people gurus during the fifty various other qualified professions that have downpayment and you will closing pricing assist with assist earliest-day, income-qualified homeowners pick an initial residence regarding teams it suffice.

So you’re able to qualify for this option, homeowners must connect with an acting financing manager, has the absolute minimum credit history out of 640, bring qualification for starters of eligible job, and you will meet the earnings endurance due to their condition. Eligible individuals will get doing 5% of your own first-mortgage amount borrowed (to all in all, $25,000) inside deposit and you will closure pricing assistance in the form of a good 0%, non-amortizing, 30-12 months deferred second mortgage.

Assets Tax Exception to this rule

One home had and you will made use of because a homestead from the a great seasoned who had been honorably released and has been specialized while the which have a help-linked, permanent and you may total impairment, is excused out of taxation of one’s veteran are a permanent resident off Florida and has now courtroom name to your assets to the January hands down the income tax seasons for which exception to this rule is being said. (FS (1))

People a property possessed and put since good homestead by the thriving lover away from a person in the fresh Armed forces whom died off services-linked reasons during active obligation is actually excused out of tax in the event the the fresh associate are a permanent resident of condition for the January one of the season in which the member passed away. (FS (4)(a))

In the event the, up on the newest loss of the latest seasoned, the fresh new mate retains the brand new judge or of good use label to your homestead and you will forever resides truth be told there, the fresh new exemption away from taxation sells out to the benefit of the fresh new veteran’s mate until particularly big date when he or she remarries, sells, otherwise disposes of the home. Should your lover carries the house, an exemption to not ever exceed the amount offered regarding the very present advertising valorem income tax move may be gone to live in the newest quarters provided its made use of the primary quarters and the fresh new mate doesn’t remarry. (FS (3))

Any a residential property made use of and you can had because the an effective homestead because of the one quadriplegic is excused away from taxation. Pros that happen to be paraplegic, hemiplegic, otherwise forever and entirely handicapped just who must use an effective wheelchair to possess mobility, or is legally blind, is generally excused off a home income tax. Check with your regional possessions appraiser to choose when the terrible annual household income qualifies. The brand new seasoned must be a resident from Fl. (FS )

Qualified citizen veterans with good Va official solution-connected handicap of 10 percent otherwise greater might be entitled to a good $5,000 assets income tax different. The fresh experienced must present so it difference for the state taxation formal on county in which he or she resides by giving files for the impairment.

The fresh new unremarried enduring spouse out of a disabled ex-servicemember, just who for the date of the disabled ex lover-servicemember’s death was partnered to the ex lover-servicemember, is additionally permitted that it exception to this rule. (FS )

Any partly handicapped seasoned that is ages 65 or elderly, people part of whoever handicap are treat-relevant, and you will who was simply honorably discharged, ount from ad valorem income tax to the homestead commensurate with the fresh new portion of the fresh new veteran’s long lasting solution-linked disability. Eligible pros would be to sign up for that it benefit at the condition assets appraiser’s office. (FS ) Amendment six, which will help spouses regarding old handle veterans that have solution linked handicaps keep the earned property income tax disregard abreast of the new passage through of the newest veteran, has gone by which have nearly ninety per cent of choose. Over 9 million voters accepted the state constitutional modification for the .

Provider users permitted the new homestead difference contained in this condition, and who’re unable to file privately by reasoning of for example service, could possibly get document because of 2nd off kin otherwise a properly subscribed member. (FS )

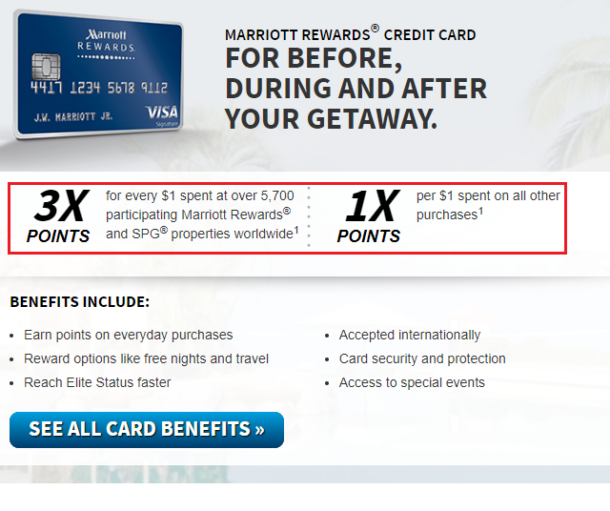

Mortgage brokers

Grams.I. Home loan Be sure The new Virtual assistant could possibly get ensure element of your loan towards buy away from a property, are produced house, otherwise condominium. At the same time, veterans having traditional home loans now have choices for refinancing so you can a great Virtual assistant protected mortgage due to the Veterans’ Professionals Improve Operate regarding 2008.

To own 24/seven guidance, call the fresh Federal Experienced Drama Hotline within 988, Force 1. You can even telephone call the fresh new Florida Veterans Service Range within 1-844-MyFLVet (1-844-693-5838) otherwise control 211.