To be considered, you prefer a credit rating of 640

The IHCDA has the benefit of a mortgage borrowing certification which will help first-go out homebuyers and you may veterans qualify for a much better real estate loan.

There are gives and you will financing having advance payment otherwise closure rates guidelines from Iowa Funds Expert. Assistance is designed for one another first-day home buyers and you will pros. If someone else is purchasing property in a decreased-earnings census tract, they may additionally be qualified. The fresh new Iowa Funds Authority operates the same program to have recite domestic consumers.

Very first Household DPA Mortgage

The initial Household Down-payment Advice (DPA) Loan program was designed to let qualified very first-day home buyers employing advance payment and you can settlement costs. The application offers a no-notice financing of up to $5,000. This deferred loan needs no monthly payments, however it will have to be paid in case the house is sold, refinanced, or even the first mortgage try paid-in complete.

Basic Domestic DPA Grant

Eligible earliest-go out homebuyers is found a give of up to $dos,500 from Very first Household DPA Give to pay for off percentage and you will closing costs. Due to the fact it’s an offer and not financing, you don’t have to pay it off.

Residential property for Iowans DPA Mortgage

The new Belongings to possess Iowans system provides a zero-focus mortgage as high as 5% of the home purchase price for usage for an all the way down commission and closing costs. Such as the First Domestic DPA Loan, no repayments are required before house is offered, refinanced, and/or first-mortgage was paid-in full.

IFA Military Homeownership Advice

The newest IFA features designed the brand new Military Homeownership Advice program once the a great special initiative so you’re able to prize and support army employees and you will pros. Eligible service members and you may pros to invest in a property during the Iowa normally receive a $5,000 grant towards the advance payment and you may settlement costs through this system.

Kansas basic-go out homebuyers is actually lucky for usage of nothing, but around three statewide advance payment guidance software, making sure many different choices to match various other means.

Kansas Homes Earliest-Date Homebuyer Program

The fresh new Kansas Property Information Business (KHRC) has the benefit of special mortgages along with numerous advance payment advice options for buyers on Sunflower Condition. People is acquire fifteen% otherwise 20% of one’s price of your house just like the a hushed second mortgage, without the need to make monthly premiums.

- The loan is actually forgiven immediately after a decade, provided the new borrower stays in the home and you can has never ended up selling, transferred, otherwise refinanced their home loan towards the end of this months

- For those who circulate, sell, import ownership, or re-finance within those individuals 10 years, you still owe the fresh new portion of the loan who may have not been forgiven.

- Qualification requirements were meeting earnings constraints (yearly earnings are unable to surpass 80% of one’s town average income) and you may adding no less than step 1% of residence’s cost from your pouch.

Due to preexisting DPA software, this isn’t for sale in Topeka, Lawrence, Wichita, Ohio Area, otherwise Johnson State. Have more information from the KHRC webpages.

Kansas DPA

While the Kansas DPA is not connected to KHRC, so it statewide advice system can help with closing costs otherwise a beneficial down-payment. Furthermore, it may present a thirty-year real estate loan that have a fixed interest.

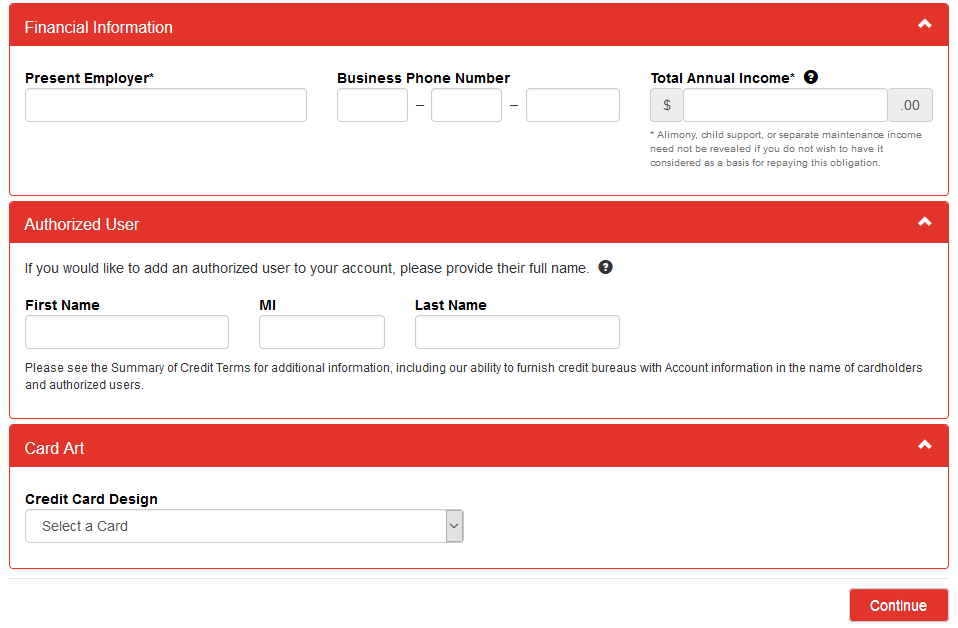

- Eligibility criteria were meeting income restrictions and having a credit score with a minimum of 640

- Customers must also explore a prescription lender

Your website does not give far outline concerning the level of advice you can discover. Making it far better get in touch with one of the main participating lenders or chat directly to new Kansas DPA. You can find email address toward system web site.