To buy a car or truck which have Navy FCU pre approval. – myFICO Message boards

Arrive with capital Financial support is actually flexible and certainly will getting confusing, so envision using a great pre-recognized bring, particularly you to through Pursue Automobile. Having Pursue Automobile you can get resource and you can arrived at the provider once you understand just how much you might spend. Good pre-recognition is commonly perfect for a specific amount of returning to a certain amount of currency. It opinion isnt accusing you out of anything. I am pre-acknowledged to have a good $25,000 car finance, although vehicle I want to purchase was $28,000 MSRP. You will find enough in my own bank to invest the remaining balance. Have a tendency to a car dealership give it time to easily implement the car mortgage ($twenty-five,000) toward auto ($twenty eight,000), after that repay the rest equilibrium into the bucks/cheque ($twenty-eight,000 – $twenty-five,000 + taxation. Bringing pre-recognition for a car loan can help you come across what you are able to afford, get the best costs, and provide you with far more independence. You should buy good preapproved financing to invest in a different vehicle otherwise a great used car.

The purchase agreement will demand make, model and you may VIN so it can go to your mortgage docs. You’ll then come back to this new dealer with the look at and you will drive out-of to the vehicles. The latest agent.

Get pre-qualified for an auto loan in two times – C.

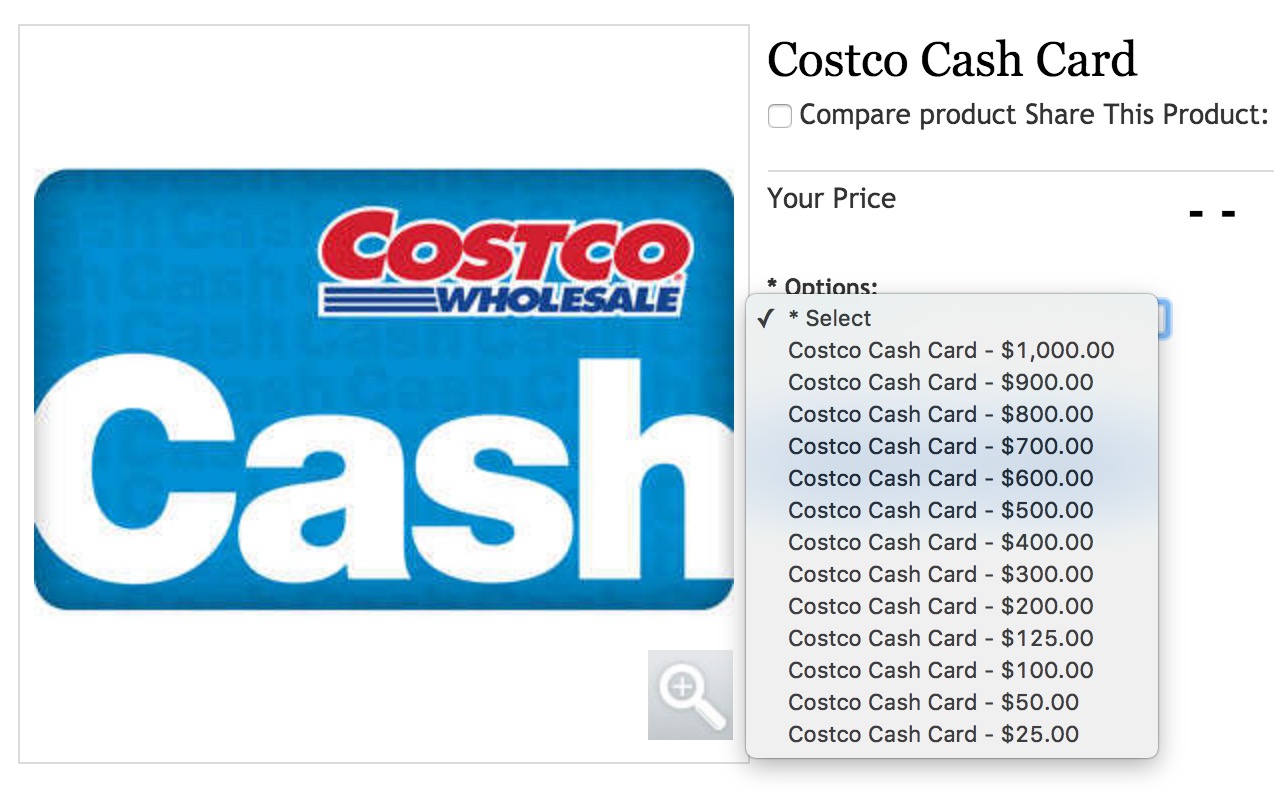

Your apply for the loan and also pre-recognized up to $X matter. Let’s make use of $20,000 because the our example. USAA, about, creates a literal blank check in PDF format on how best to. If you’re searching for good price and don’t need to handle broker money, get a good Costco membership, select the vehicle need during the a performing broker and present them the.

Why should you Rating a great Preapproved Auto loan and you can Where you can Find one.

You could potentially fund the car, TTL, warranties an such like so long as the entire is actually smaller then your count toward pre approval together with LTV is actually 125% I believe having Navy. you will be Fed Ex’ed brand new write check and you may documents and that usually will come in 2 working days (or you can figure it out within a part) Then you definitely bring it to your dealer and purchase your vehicle!. Re: How to proceed once pre-recognized to possess auto loan. You are considering a questionnaire that broker faxes to your lender. Always you can print the design out of your on line usage of the bank. Often the agent are desperate to overcome the newest pre-acceptance. Therefore, provide them with a try during the overcoming they. Choose for this new quickest label you are able to afford.

Preapproval means a loan provider possess analyzed your credit report (not just brand new get) or any other information to choose an amount borrowed and rates you may be going to found. Tough credit eliminate. You can easily. My personal agent wouldn’t hold autos unless of course you have signed a binding agreement otherwise youre a duplicate buyers. Very first come earliest suffice. When you’re out getting the own capital, and individuals strolls into the. Get preapproved for a loan one which just place base installment loans Jacksonville from inside the an effective dealer’s parcel. “The new unmarried best recommendation I’m able to give some body is always to get preapproved having a car loan from the bank, a credit commitment or an internet.

Vehicles to acquire: Pre-accepted mortgage away from lender, how come to get towards.

Sure, it preapprove a max number for each label duration, and you may afterwards decide which duration need, and can get a motor vehicle really worth to the absolute most, and you can. Yes, preapproval may affect car finance rates in two means: Permits that see what speed you could potentially be eligible for and offer your a tool to aid negotiate less price that have a loan provider. Instance, say you had been preapproved to own 11% Annual percentage rate. You could enter a car dealership and gives the fresh new sales rep 8%.