When you have less than perfect credit and you also need good mortgage into the a house, you’ve still got specific alternatives

Do you know the Standards getting a hard Money Loan?

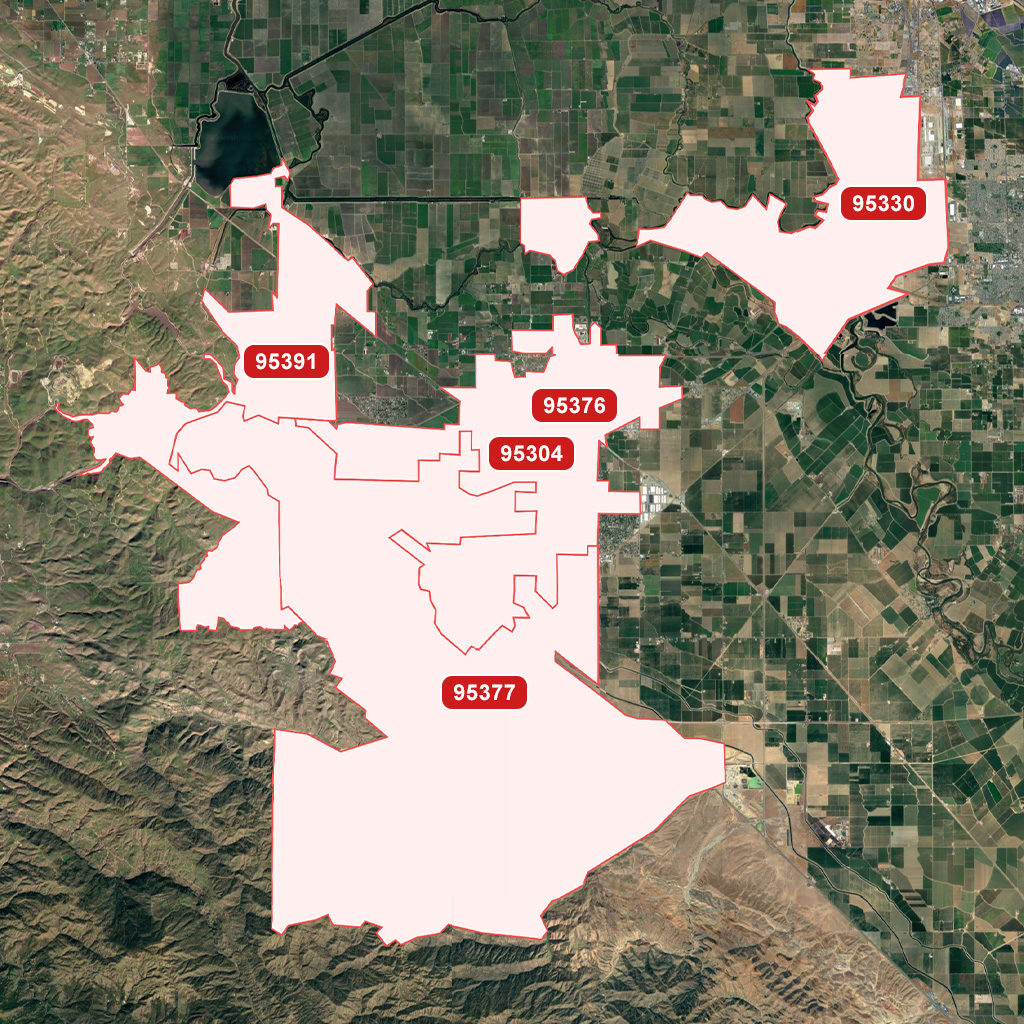

Locate a painful currency financing, you should have a genuine home possessions your bank deems from sufficient really worth and you can potential earnings accomplish that loan towards the. You need to do your own research into the possessions, neighborhood, property beliefs or other items to decide if there’s sufficient cash in the offer to make it a great flip applicant (really hard money funds are used for six-a dozen few days flip systems).

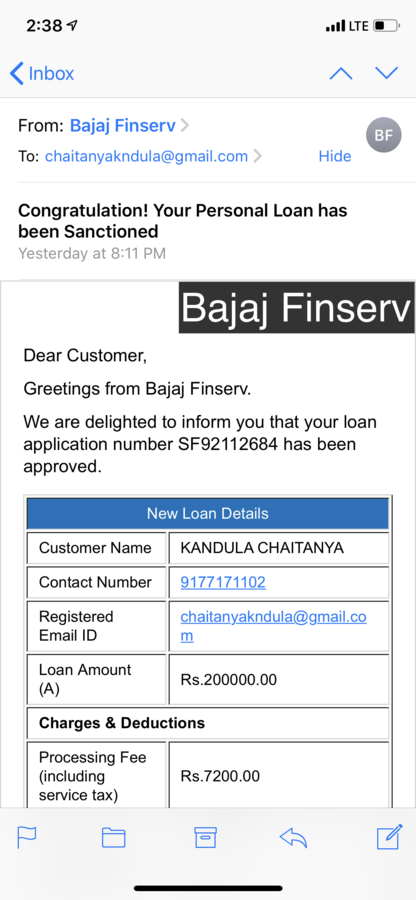

Be sure to help you will often have downpayment out-of twenty five% or 30%, though some lenders will need quicker (having increased rate of interest).

What exactly is a challenging Money Loan for Poor credit?

Tough currency loan companies generally dont put far increased exposure of the fresh new borrower’s borrowing from the bank reputation while making a credit decision. Of a lot difficult currency lenders legs the latest lending choice toward well worth of the property as well as possible just after fix value otherwise ARV. So, if you have bad credit, this is not always a barrier to getting an arduous money financing.

Manage Difficult Currency Lenders consider borrowing from direct express emergency cash 2022 the bank?

Particular difficult lenders can get look at your credit history but doesn’t basically ft its lending decision on this subject amount by yourself. The big procedure he is worried about is the condition away from the house or property we need to spend money on and you can just what its likely money was just after it is repaired. Hard currency lenders will get remark your tax returns and financial statements and you may borrowing from the bank, nevertheless the prospective of the home was most critical. (biggerpockets)

Try a difficult Money Loan considered a cash out transaction to possess underwriting purposes?

A painful currency financing otherwise private money loan is noticed an earnings offer. This is because the money is often available inside a week while the financial has made a decision in order to give on a specific assets. That is one of the major reasons that folks turn-to tough currency: They must score bucks immediately to locate a bona fide property price that would be seized upwards by an alternate investor immediately.

Do you really refinance a difficult money mortgage?

Sure. An arduous currency loan is often put because a short-term financing to make sure that property are going to be rehabbed and flipped. However, circumstances happen the spot where the individual may prefer to store the fresh assets for a bit longer of your time. Such, he may choose the guy really wants to book the house or property away and you will wait for quite some time.

The new high notice character off difficult currency financing can make this an unprofitable processes. However when the house could have been fixed and will see conventional financing criteria, you can easily re-finance outside of the tough currency loan and you will on a traditional, straight down focus mortgage. Don’t get worried, the RefiGuide will help you to understand how to refinance an arduous currency loan that improves the money you owe.

Are hard currency money attention just?

Whenever a debtor takes out an arduous currency financing for financing purposes, they typically are extremely high attract simply fund that are implied for use to possess half dozen so you’re able to 1 year so you’re able to flip a great possessions, usually. There isn’t any prominent paid with this style of tough currency loan. Whenever a borrower is looking for a difficult currency mortgage to cease foreclosure, he or she is normally getting funding terms of 15 so you can 30 years, on the intent refinance towards less interest whenever the borrowing from the bank rebounds.

Just remember that , in addition to expenses large focus from 10-15% towards financing, in addition could be energized 2 to 3 issues from inside the running fees. Thus, you can expect to pay a few thousand dollars when you look at the fees plus the focus to your mortgage.