How exactly to hold the finest HELOC rates for you?

Fundamentally, new payment months uses the eye-simply several months, where you must initiate paying off the brand new a fantastic equilibrium, along with one another dominant and notice. The brand new payment several months usually selections of 10 so you’re able to 20 years, according to the regards to their HELOC. Monthly payments during this period was more than focus-simply money, because they safety one https://paydayloansconnecticut.com/riverton/ another desire charge and you may an element of the dominant harmony.

Of the understanding the mark and focus-simply months, and cost period, you could efficiently take control of your finances while making the absolute most away from your house equity line of credit.

Simply how much ought i get?

One of the trick considerations when obtaining good HELOC are choosing just how much you can access. The degree of cash you can buy off good HELOC would depend with the several things, including your residence’s value, your existing mortgage balance, your credit rating, plus the loan amount you be eligible for. Generally speaking, loan providers create access to from around 75% so you can 90% of one’s house’s worth, minus their outstanding financial balance.

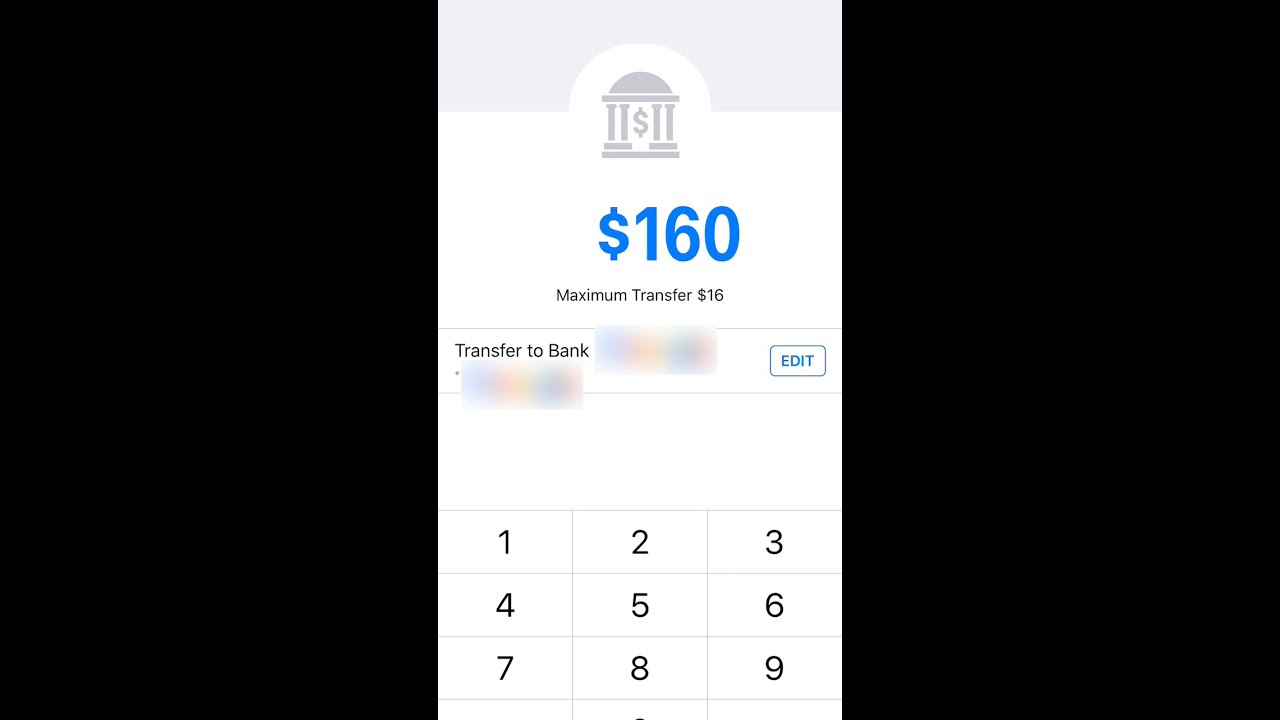

To track down an estimate from exactly how much you can access, you should use Better’s HELOC calculator that takes into consideration their home’s well worth, loan-to-well worth ratio, and you may credit score. You should remember that loan providers think about your debt-to-income proportion to evaluate your capability to settle the new line amount.

How to rating a beneficial HELOC?

The applying procedure to possess a beneficial HELOC involves bringing private monetary information, as well as your income, household worth, and you can current mortgage balance. Loan providers feedback your credit report, credit rating, and you will current home loan to evaluate the application. You could potentially apply for a good HELOC using Better’s 100% digital application. You should buy a good pre-acceptance in as little as three full minutes no effect so you can your credit score.

Better’s HELOC

With Best Mortgage, you could over the HELOC application completely online, reducing the need for physical documents along with-person check outs. This electronic software techniques besides conserves go out but also brings enhanced protection to suit your private information. Better’s smooth process will bring borrowers with smaller entry to money, potentially enabling you to found cash in as low as 7 weeks.? By opting for Better’s electronic app techniques, you may enjoy a smooth experience therefore the convenience of handling your house collateral line of credit right from the house.

Protecting an educated HELOC rates is very important when leverage your residence equity. Doing so could easily help save you thousands of dollars during the focus costs along the life of the loan. To ensure you earn an educated speed it is possible to, look at the pursuing the steps:

- Display screen your credit rating daily and take steps adjust it, when needed.

- Manage an excellent credit history through quick money and to stop excessively credit debt.

- Maximum new borrowing applications and concerns because they can briefly all the way down your credit score.

- Talk about price deals offered by lenders for situations such as for instance automatic fee or maintaining the very least credit history.

- Contrast cost and you can terminology of numerous loan providers to find the best offer to suit your economic need.

- Of the applying such tips, you could potentially improve your likelihood of securing a good rate for your home security credit line.

Methods to change your credit score

If you’re aiming for a much better HELOC rate, bringing strategies to switch your credit score is crucial. Here are a few steps that can help you boost your borrowing score:

- Make quick payments into the any borrowing from the bank financial obligation, and additionally credit cards, funds, and mortgage loans.

- Look at your credit reports on a regular basis to possess mistakes and you can conflict one inaccuracies the thing is.

- End closing bank card profile, since lengthened credit rating normally definitely impression the score.