Hence, the house In a position and you will Household You can easily mortgage programs work on lower- and you will -reasonable earnings borrowers

Very own Right up Staff

Very own Up try an individually held, Boston-situated fintech business which is towards a goal to ensure every household customer get a reasonable contract to their home loan from the for any reason strengthening those with tailored study, customized pointers, and you can unmatched use of mortgage lenders to help make greatest economic consequences and you can express the house financing experience.

Homeownership is known as the latest American http://cashadvancecompass.com/personal-loans-wi/abbotsford Fantasy, a dream this new You.S. Census Bureau informs us 65.1% of all the house achieved on 4th quarter off 2019. But it amount is mistaken. Having homes making more compared to the average friends money, homeownership is at 78.8%. Having households and come up with less than the average relatives money (and that disproportionately is sold with minorities), this new homeownership speed are 51.4%. None ones amounts has evolved much once the 2014.

Going then to 2005-during the height of your casing ripple-low-earnings homeownership costs was basically like what they are now. High money homeownership rates, though, was indeed a lot higher-6 payment affairs more than today. It shows a familiar myth in regards to the houses crisis in the 2008: They failed to, since thought of, disproportionately apply at minorities and you may lower-income homes. As an alternative, one to classification have usually experienced a great deal more barriers so you’re able to homeownership.

Brand new Brookings Institute reported this among the biggest instructions of overall economy, calling the reduced-money homeownership a catch-22 condition that needs to be damaged. Usage of home ownership facilitate generate money and financial stability as mortgages usually are lower than book and build guarantee throughout the years, but financial stability must supply home ownership.

The brand new applications target the main traps in order to home ownerships, because outlined by Metropolitan Institute: large down payment, credit history, value and use of down payment recommendations.

The lower-Income Borrowing Alternative

The greater understood bodies-supported financing apps focus on a particular sector out of homebuyers and you will tend to be FHA funds often marketed to first-day consumers, Virtual assistant fund to possess pros and you may USDA loans for all those to purchase for the outlying components. These types of software give lower down money and less strict terminology than just conventional finance, and are offered to buyers regarding differing income account.

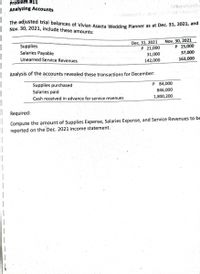

Family In a position (by the Fannie mae) and Household You can (from the Freddie Mac) are just accessible to lowest- and you will moderate-money family members. The federal government-supported finance include a downpayment as little as 3 percent. That is far below the 20 percent necessary for a traditional financing.

Borrower Conditions

The house Able and you will Home You’ll software are very similar. An important attribute is because they are money centered. And that system a borrower is out there will be based upon and therefore program the lender underwrites in order to. The latest conditions on programs include:

- Debtor money should be below 80 per cent of your own town average earnings (AMI) since , which includes exceptions according to the properties venue.

- Adjustable-price mortgage loans (ARM) are permitted.

- Consumers that have nontraditional borrowing histories can be considered. If you don’t credit scores as little as 620 is approved.

- Reduced financial insurance policies choice.

- Single-relatives belongings of just one- so you can cuatro tools, are formulated property, condos and you can structured equipment developments all of the be considered, with constraints.

- Loan to help you worth (LTV) constraints all the way to 97%.

- Homeownership studies criteria.

- A personal debt-to-money proportion around 50% with regards to the mortgage.

Just how such Finance Let Reduced-earnings Individuals

Because of the tighter borrowing from the bank ecosystem following the construction ripple burst, of a lot individuals was in fact shut out of one’s business and possess perhaps not were able to benefit from low interest rates and affordable home prices. Information on how Family In a position and you will House You can elevator such traps:

- Down-payment and you will the means to access down-payment advice: The newest deposit demands should be confronted with money from presents, grants another loan through the Community Seconds (Federal national mortgage association) program or Sensible Moments (Freddie Mac).

Analysis so you’re able to FHA Money

Domestic In a position and you can Home You can money resemble FHA loans where they supply the lowest down-payment from as little since the step three%, as compared to as little as 3.5% for FHA money. However, Household In a position and Home You’ll be able to fund offer this type of trick experts more than FHA funds:

Try this type of Loans High-risk?

Some people get care these particular is actually solution funds on account of their faster degree criteria. That isn’t possible. By law, a professional financial is just one where consumers are presumed for the capacity to pay and you can loan providers are protected from litigation stating it failed to be sure the fresh borrower’s capability to pay. Funds supported by Fannie mae and Freddie Mac computer have to fulfill these types of requirements.

Whom Underwrites such Money?

underwrite that loan right after which sell to help you a larger financial lender also provides this type of financing. Very borrowing unions otherwise shorter finance companies does not.

The way we will help

I been Realize enable homeowners having individualized studies and you can objective recommendations so they are able improve most readily useful economic decisions for their own disease. Our very own uniquely clear enterprize model is actually prime alignment with the consumer, therefore we are just incentivized to act in your best interest, not ours. We give users sincere, professional advice, if or not that means assisting you submit an application for a property Able otherwise You can Mortgage, or describing as to the reasons that isn’t a good fit for the problem and you can providing advice on options.

If you would like get the full story and so are new to Individual Right up, get the four-moment survey to construct your own profile and you may plan a trip having a professional Home Advisor to get started.