One-Time Intimate Finance are around for FHA, Virtual assistant and you can USDA Mortgage loans

FHA mortgage laws and regulations require an assessment of the property protected of the the loan regardless of whether it’s an existing framework house or if you choose to make on your own land playing with a beneficial One-Time Romantic loan.

However, if the FHA appraiser discovers a thing that will not satisfy regional strengthening code, or if perhaps discover a ruin exposed within the assessment (mentioned are a couple examples of just what can happen during the appraisal time to the a new framework house) those circumstances should be corrected.

HUD 4000.step 1, the fresh new FHA Single-Family home Mortgage Manual, instructs the lending company one in cases where the new appraisal uncovers things that do not meet the FHA minimum assets important, the newest Appraiser must report the brand new repairs necessary to result in the Property comply, bring an estimated rates to treat, bring descriptive images, and condition the new appraisal into expected solutions.

FHA Loan Appraisal Requirements: Solutions

But you to definitely projected pricing to correct the difficulties should also fulfill FHA advice. It were, but they are not restricted so you can, conditions for the next:

If conformity can only just feel affected by major fixes or changes, brand new Appraiser have to report most of the easily observable possessions deficiencies, plus any desperate situations discover starting the research with it when you look at the completion of your own appraisal, during the revealing function.

- maintain the cover, security and you can soundness of the home;

- maintain the fresh new went on marketability of the home; and you can

- manage medical and you can cover of residents.

Brand new design home aren’t 100% defect-free 100% of time. Consumers should not imagine a different sort of structure house is primary, and it’s really vital that you enjoy the need for more conformity checks or any other expenses regarding new assessment when alterations are needed.

You will possibly not actually spend any cash (if you have no importance of a conformity inspection, for example, at all) but which have that money and in case is a huge assist afterwards in the mortgage processes.

Such loans and pass by the following names: step 1 X Personal, Single-Romantic Financing otherwise OTC Mortgage. These types of mortgage makes it possible for you to definitely finance the purchase of your land in addition to the construction of the home. It’s also possible to use home that you own 100 % free and you can obvious or have a current mortgage.

I’ve complete detailed browse towards FHA (Government Homes Management), the newest Va (Agencies off Pros Products) additionally the USDA (United states Company out of Agriculture) One-Date Romantic Build loan software. You will find verbal to licensed loan providers you to originate these types of residential loan brands in most states each business possess provided united states the principles due to their things. We could hook you having mortgage loan officials who do work for loan providers you to definitely understand tool better as well as have constantly provided top quality provider. When you find yourself searching for being contacted to 1 subscribed build bank towards you, excite publish solutions toward questions lower than. All the data is treated in complete confidence.

OneTimeClose provides pointers and connects consumers to accredited That-Day Intimate lenders as a way to boost awareness about any of it loan unit in order to let consumers receive higher quality solution. We are not covered promoting otherwise recommending the lenders or loan originators and do not if not benefit from doing so. People will be go shopping for financial attributes and you will examine their choice ahead of agreeing to help you go ahead.

Please note that investor guidelines for the FHA, VA and USDA One-Time Close Construction Program only allows for single family dwellings (1 unit) and NOT for multi-family units (no duplexes, triplexes or fourplexes). You CANNOT act as your own general contractor (Builder) / not available in all States.

While doing so, this might be a limited variety of the following property/strengthening looks which are not enjoy significantly less than this type of programs: Package Homes, Barndominiums, Vacation cabin or Bamboo House, Shipping Basket Belongings, Dome Belongings, Bermed Planet-Protected Property, Stilt Property, Solar (only) otherwise Snap Driven (only) Home, Small Homes, Carriage House, Connection Dwelling Gadgets and A-Presented Homes.

Your own email in order to authorizes Onetimeclose to generally share your own guidance having a home loan framework financial registered in your area to get hold of you.

- Posting your first and you may past title, e-post address, and contact contact number.

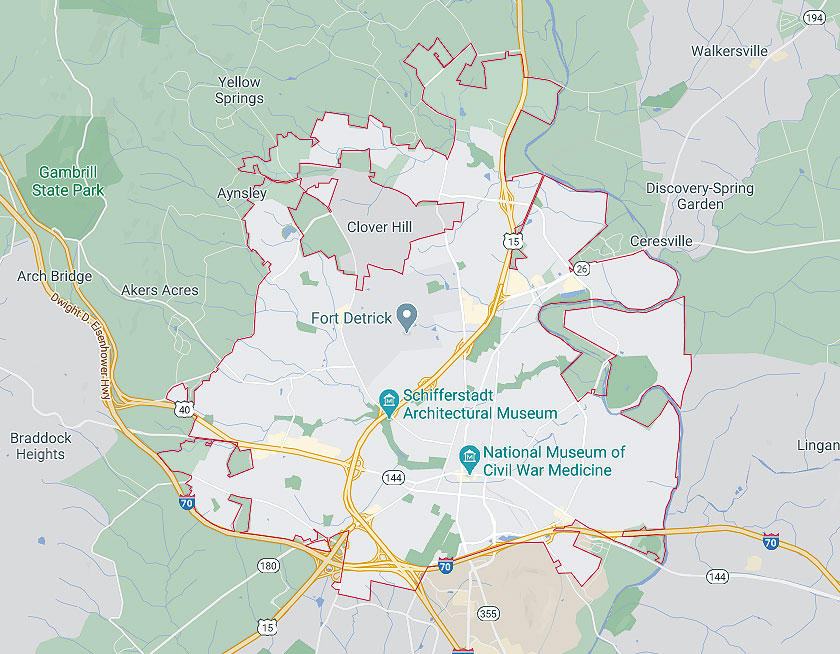

- Inform us the metropolis and you can county of your proposed property.

- Write to us your and you may/and/or Co-borrower’s borrowing from the bank character: Higher level (680+), A good (640-679), Fair (620-639) otherwise Poor- (Lower than 620). 620 ‘s the minimum qualifying credit score because of it equipment.

- Are you presently or your wife (Co-borrower) qualified experts? If the possibly of you are eligible veteran’s, off costs only $ount the debt-to-money proportion Va enable there are no restrict loan numbers according to Virtual assistant advice. Very lenders will go as much as $1,000,000 and you will remark high loan numbers into the an instance from the case basis. Otherwise an eligible seasoned, the newest FHA down-payment is step 3.5% around this new maximumFHA financing limitfor your condition.

Bruce Reichstein provides spent more 3 decades since the a skilled FHA and you will Va home loan financial banker and you can underwriter where he had been accountable for resource Billions in bodies supported mortgages. He could be new Handling Publisher to own FHANewsblog where he educates home owners into the specific recommendations to possess obtaining FHA protected mortgage brokers.

Archives

- 2024

On the FHANewsBlog FHANewsBlog was released in 2010 by experienced mortgage masters attempting to educate homeowners regarding the guidance to possess FHA insured mortgage financing. Preferred FHA subjects are borrowing from the bank standards, FHA mortgage restrictions, mortgage insurance fees, closing costs and even more. The new loans Waldo experts wrote thousands of posts particular in order to FHA mortgage loans additionally the site has dramatically improved audience over the years and you will is known for its FHA Reports and you can Opinions.

The latest Virtual assistant You to-Time Intimate try a thirty-seasons mortgage available to experienced borrowers. Borrowing from the bank guidelines are prepared because of the bank, typically with a 620 minimal credit history criteria.