The fresh feeling of exterior expenses to your providing a home loan

Even though a bank provides told you that you do not qualify getting a mortgage, do not just just take it once the a total No otherwise assume that other banks also turn-down your property loan application due to the fact there is something wrong on your profile. it should never be regarded as the end of the homeownership highway. A talented and skilled mortgage broker for example Around the world Funds can look on it just like the a chance to reassess your financial reputation and you can speak about alternative avenues for securing financing. Aseem Agarwal, Direct regarding Mortgages at the In the world Money says.

Of trying so you’re able to secure home financing, never view a getting rejected in one financial once the a decisive decision on the eligibility.

Due to the fact Aseem recommends, it pays to learn where the drawback is within your home application for the loan. If you are turned-down because of the a lender, the group can perhaps work to you that assist you are aware the fresh new cause of for example choices. And even more importantly, they can give an effective way to change your possibility of approval. They’re able to ensure that the 2nd application is to your a significantly stronger ground, regardless of whether you will be deciding on an equivalent lender otherwise a beneficial additional lender.

Do i need to pay off my bills?

I expected Aseem whether repaying a personal debt will make you entitled to a more impressive loan from a lender or let your own opportunity if you’ve been refused.

Attracting of many years of experience and you may business expertise, Aseem informed you that sure, paying outside expense otherwise cutting your outside costs otherwise consolidating your additional expense will help you likelihood of taking good home loan.

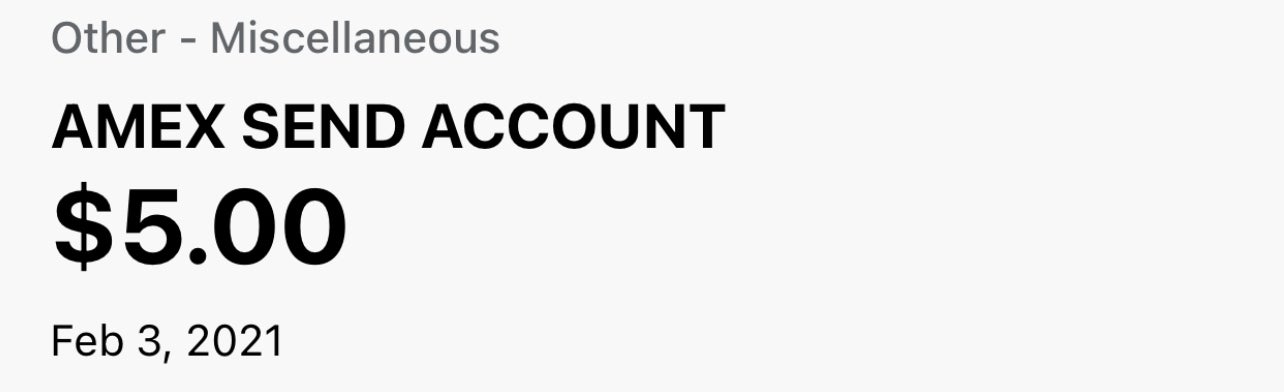

Exterior expenses, for example mastercard stability, get commands, get today shell out letter and private funds, is also rather influence the loan qualification. The guy troubled just how extremely important its that customers know how these debts connect with the financial updates when trying to get a loan. Then continued to give possibilities on exactly how to target the issues you to definitely having such additional expenses twist.

The latest perception out-of exterior bills

Usually an individual applies getting a home loan, a mortgage, or a high-up otherwise a casing mortgage, and they have exterior costs, such as personal credit card debt or signature loans, these can do an issue in terms of being qualified to receive the degree of mortgage he is trying to.

Strategies for boosting financing qualification

To decrease brand new effect out-of exterior bills on your own loan eligibility, Aseem advises proactive tips including debt consolidating and you can leverage established assets:

If you’ve been advised you’re not eligible for that loan or simply be eligible for less matter than simply youre asking getting and something of the reasons the bank has given are which you have too many external bills, then it is always worth playing these types of exterior costs and you can viewing what effect he could be wearing their application.

Every expense toward you to

Outside costs such as high-notice vehicles payments, charge card money, or financing against a business to own resource cost, are very commonly at mortgage of about 10 in order to a dozen per cent. This is certainly more than a home loan price and tenure of those fund also are faster compared to the typical twenty-five-to-30-year lifetime off a mortgage.

First and foremost, we highly recommend so you can clients this would be value looking into debt consolidation: moving most of the expense into one. We frequently highly recommend it blend large-attract finance otherwise loans toward a very without difficulty handled mortgage.

Because of the securing this type of fund resistant to the domestic, website subscribers will be able to lower the rate of interest he could be paying, and they’ll have the ability to offer the amount of time to pay them straight back. Which tend to enhances the number of mortgage the customer may then find on the lender.

Leveraging guarantee

If you have a preexisting house collection, the worldwide Financing party will feedback brand new equity you’ve got and you will strongly recommend leveraging it to repay outside bills. This will discover even more money possibilities. Aseem Agarwal demonstrates to you:

https://www.clickcashadvance.com/payday-loans-la/

Whether your consumer provides a current house collection, this may be will make experience to accomplish a peek at the fresh new guarantee currently kept in those functions. Next we consider offer these exterior expense onto the secure house or commercial possessions for them to lessen the repayments on them and therefore build themselves entitled to a greater count out-of loan.

Smoothing the best way to homeownership

Completely admiring brand new intricacies regarding home financing requires a proactive strategy and you may access to professional information. Around the globe Fund will bring full support and you may active alternatives.

Once the Aseem emphasizes: If you don’t qualify for a mortgage, it is advisable that you enter into the newest nitty-gritty off understanding why the application wasn’t recognized and looking qualified make it possible to discover what you can certainly do about this.

Home loans are present to help individuals beat barriers and started to their homeownership requirements. So, if you are searching getting educated, professional advice and you can guidance, contact the group during the Around the world Loans into the 09 255 5500 or Capable help you unravel the causes regarding home financing and you can move ahead up the assets ladder.

All the information and you will stuff published is actually correct with the good the global Loans Characteristics Ltd studies. Since pointers offered within this writings was from standard character that’s not intended to be custom economic pointers. I encourage you to seek Financial guidance which is individualized founded on your need, requirements, and activities before you make any economic choice. No body or people who depend myself or ultimately abreast of information within post could possibly get keep Around the globe Financial Characteristics Ltd otherwise its employees accountable.